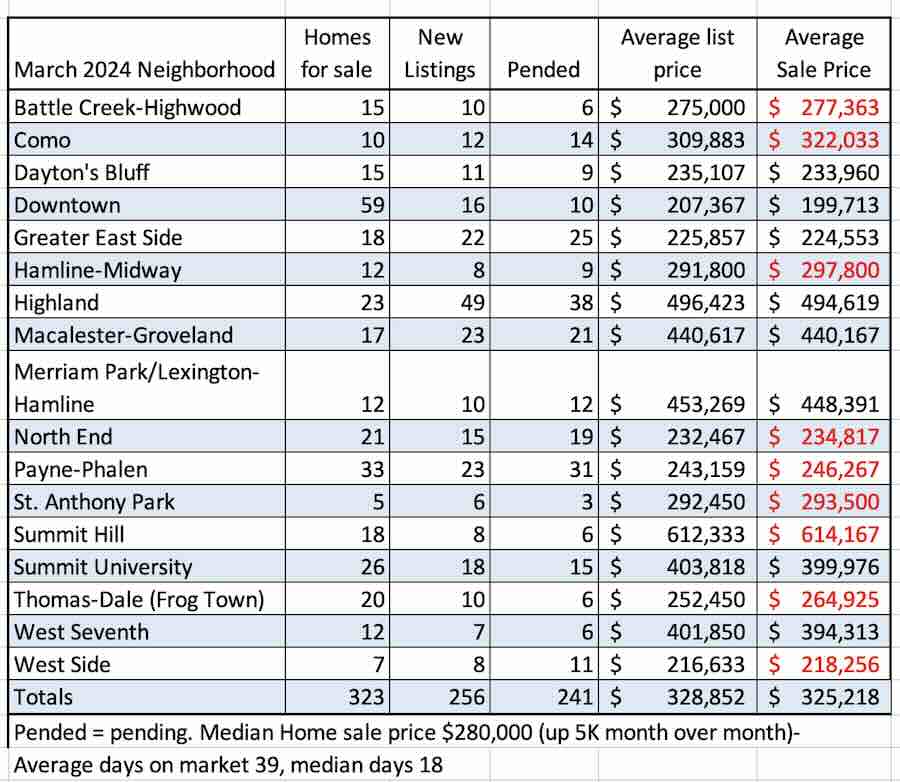

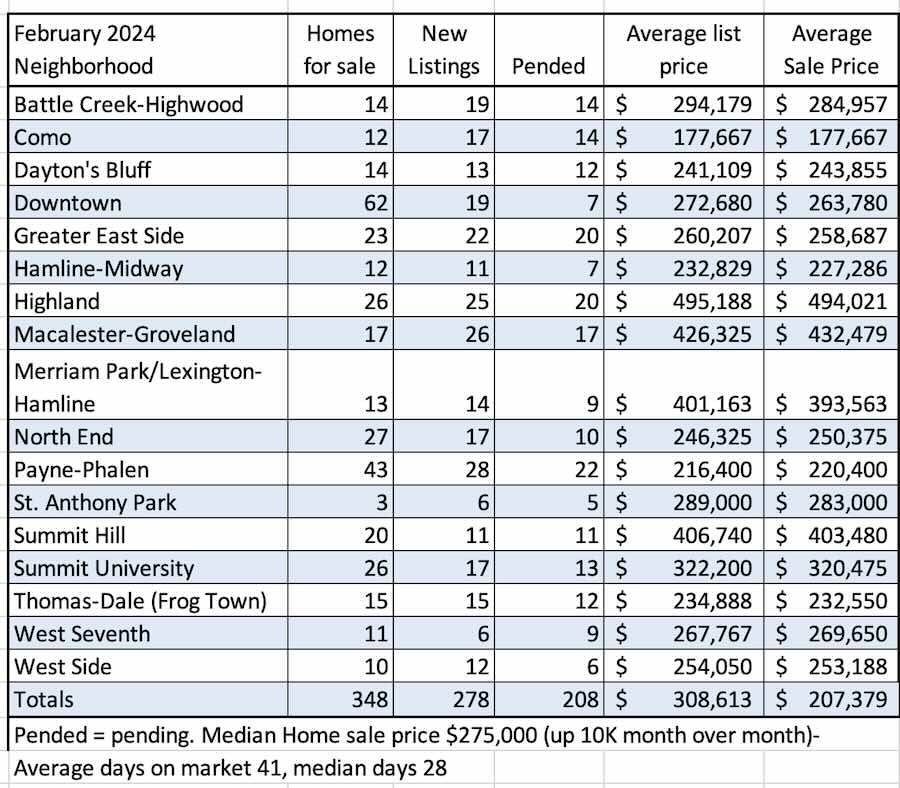

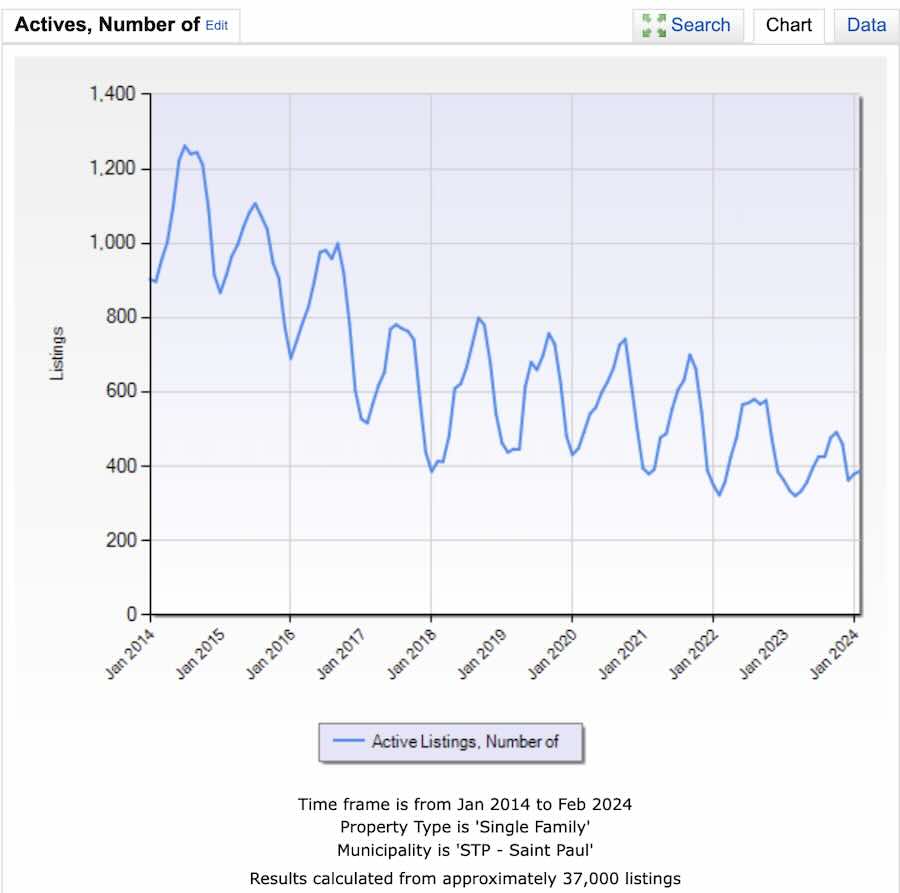

Here are some numbers by neighborhood for home sales in St. Paul Minnesota. Sales are up from last month but it sure isn’t like the old days, that long ago time when there were three times as many houses on the market in April and twice as many sales. Interest rates are high and so are home prices. When rates go down more people might be interested in moving which means prices will go up more.

The imbalance between supply (low) and demand (high) will resolve but not this year. Buyers should expect to pay more than the asking price for a house this spring and will see some of the highest mortgage interest rates in decades. Sellers can expect a quick sale but cash sales are down slightly from last year.

The data used to make the table below was extracted from the NorthstarMLS (Multiple Listing Service – a database) which is deemed reliable but not guaranteed. These are single-family homes in St. Paul, including condos and townhouses but excluding rental properties.

For more local real estate data please see Local Market Conditions & Home Prices