Anyone who says that interest rates don’t matter isn’t being truthful. Sure a person can buy a house at today’s rates ad then refinance when rates go down but that means paying less on the principal for longer.

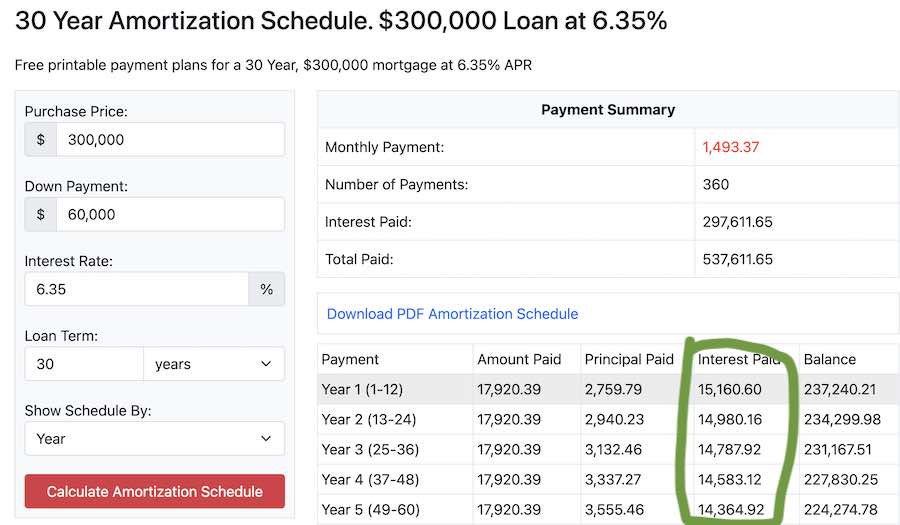

Mortgage interest is front-loaded. When the borrower refinances they start all over and make payments that are mostly interest. Ask Google to amortize a home loan for you and run some scenarios. Mortgages are seriously expensive. In the example below sometime in year 20 of the 30-year loan the principal payment is more than the interest payment. By the time the loan is paid off the borrower has paid $672,014.56.

Is a house a good investment? Not always. Owning a house free and clear has some advantages but often when it is sold the proceeds are needed to pay for housing. Please borrow responsibly.

It is possible to refinance over and over and pay mostly interest on a mortgage and very little on the principle. The monthly payments may end up being lower but who wants to pay a mortgage for 25 years and still owe most of the principle?