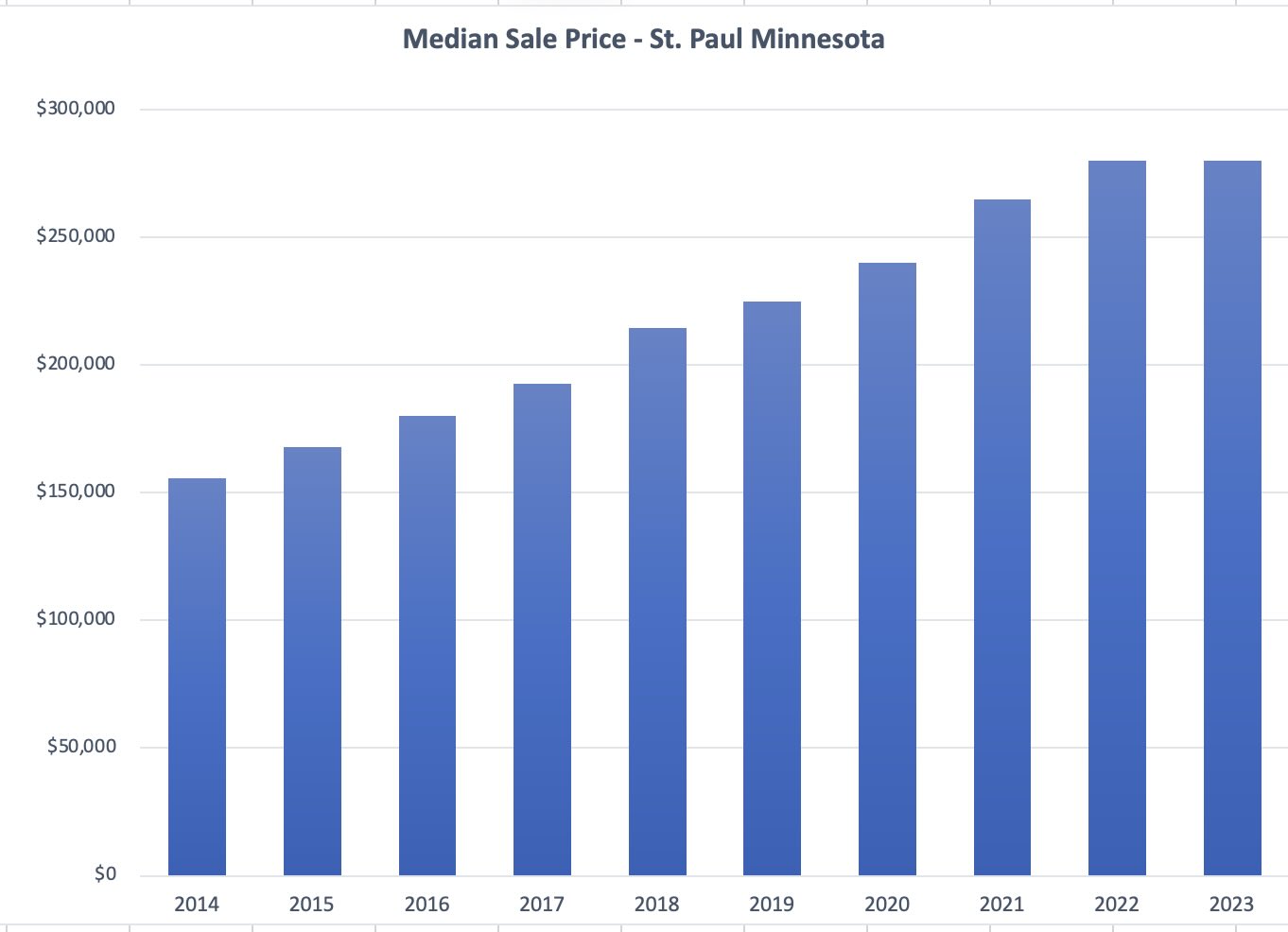

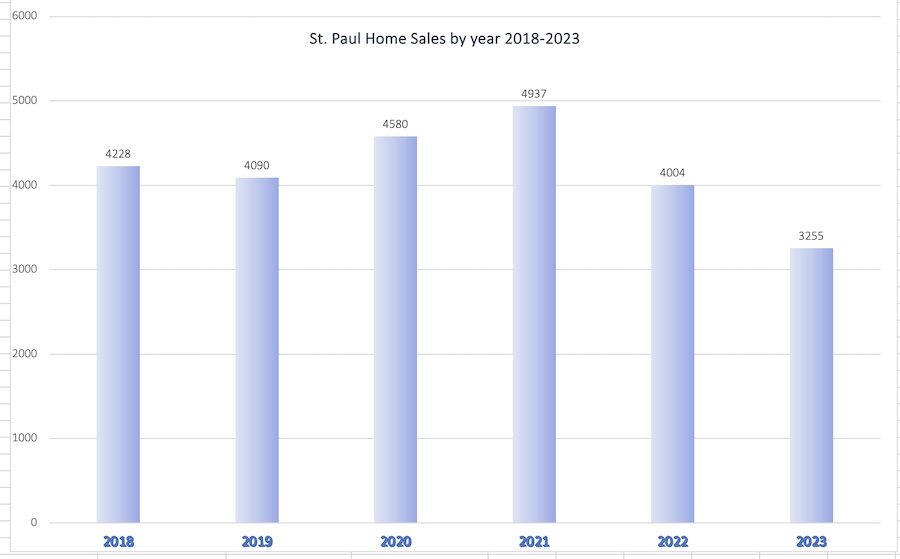

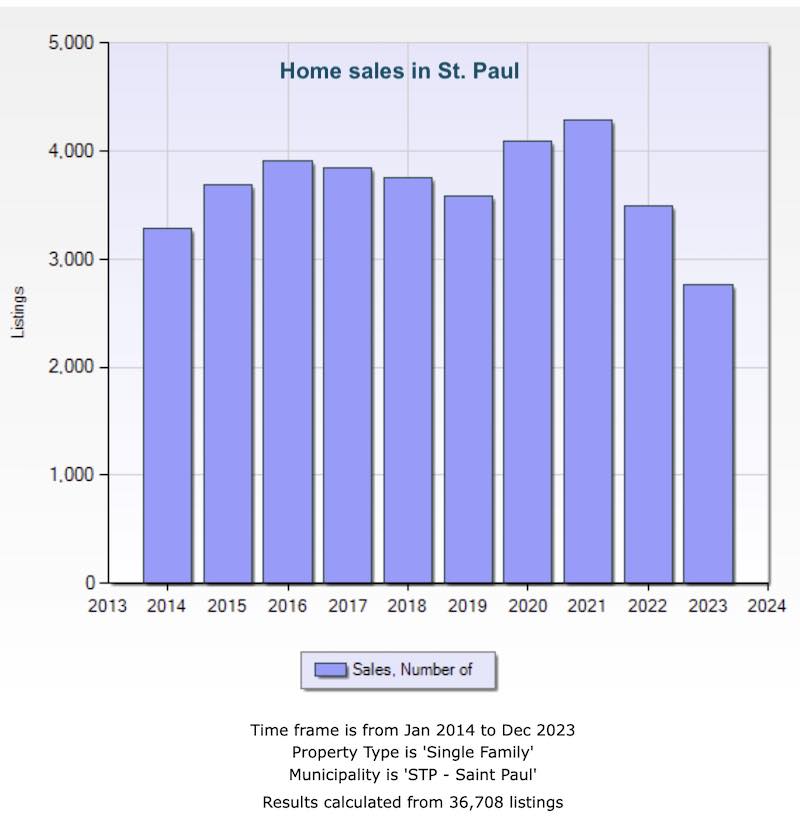

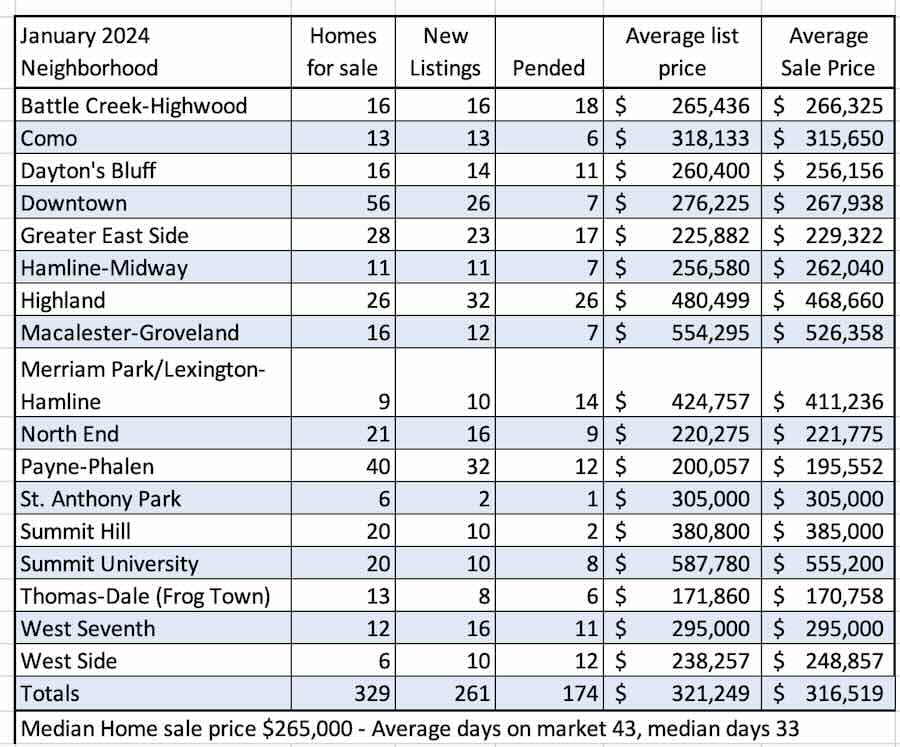

So far this year is kind of a yawner when it comes to home sales. Median home sale prices are up from last January, but everything else is pretty much the same. Fewer homeowners want to move away from the low mortgage interest rate they have and are not putting their homes on the market.

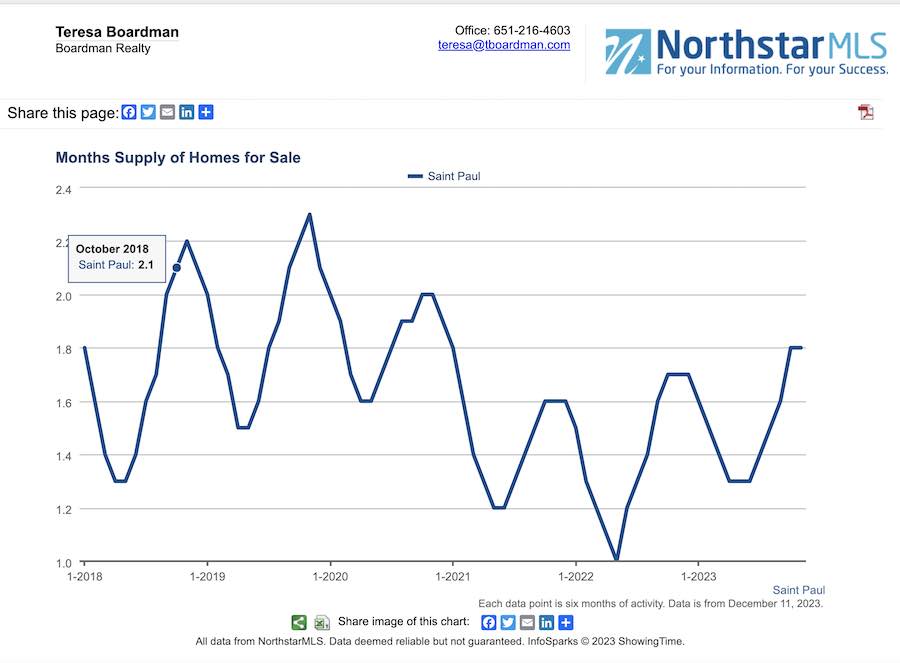

The demand for homes is high and the supply is low. We have been seeing the same trend for almost a decade.

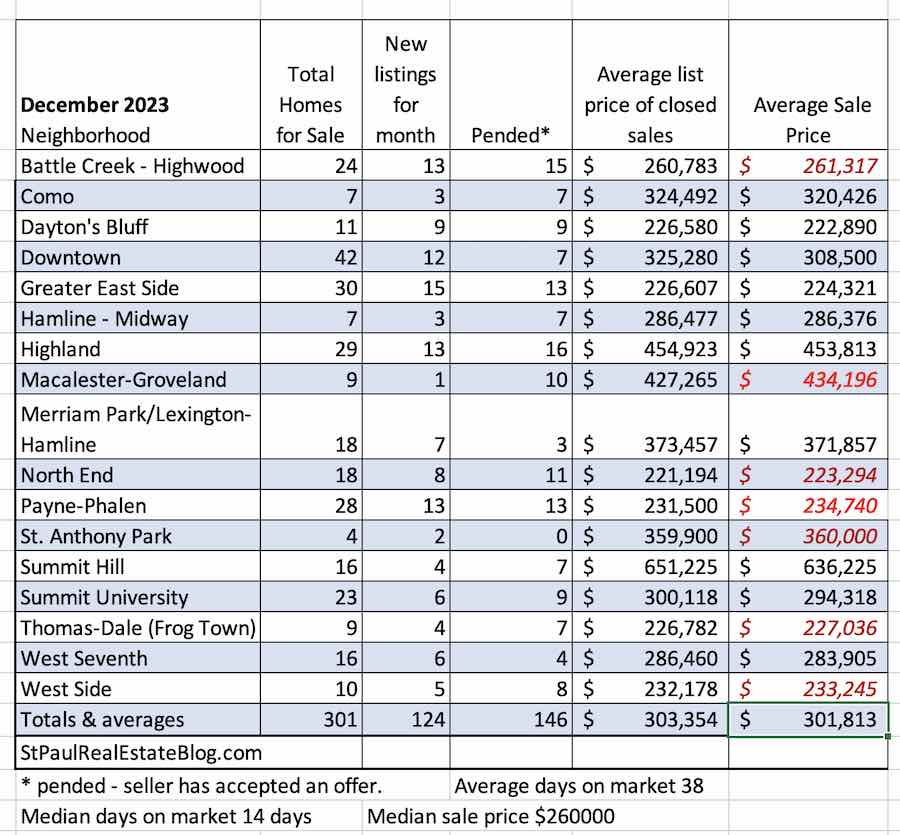

The numbers in the table below is a summary of data extracted from the Northstar MLS which is deemed reliable but not guaranteed. An MLS is a database of homes for sale that have been listed by Realtors. Homes for sale on real estate company websites and on the major real estate portal sites receive all or most of their data from MLSs.

Since real estate is local I like to publish the numbers for St. Paul, sorted and subtotaled by neighborhood.

For more local numbers and information please see Local Market Conditions & Home prices.