Many of us use “smart home” technology. For example, I have a thermostat that is on the internet and can be controlled with my phone. Same with the washer and dryer. I am interested in getting some smart locks so that I can lock the backdoor from anywhere or maybe just check to see if it is locked.

washer and dryer. I am interested in getting some smart locks so that I can lock the backdoor from anywhere or maybe just check to see if it is locked.

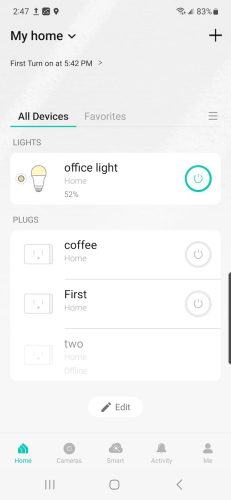

Some of our light bulbs are smart bulbs that I have on timers and I have some smart electrical outlets that are on schedules. One of them controls some lights that come on at sunset.

There is a camera in my office that is also on the network. I can control it with my phone and I can see what is going on in my office from anywhere. Several of my neighbors have “Ring” doorbells so they can watch the packages being stolen from their front porch from anywhere or just replay it when after they notice the packages missing.

In the standard Minnesota purchase agreement used by Realtors, it says that the homeowner has to give the home buyer the passwords and control of smart home technology.

I recently read an article about how a homeowner in another state could not control the devices in his home. I think it was one of those stories based on an idea a reporter had and he found someone to go along with it. I can see so many workarounds including removing the offending device.

For one thing, as soon as these devices are off of wifi they can not be controlled. Once they are on new wifi the owner should be able to reprogram or find someone who can.

Most homeowners do not leave active Wifi behind. Thermostats can usually be controlled at the thermostat. They can also be reset completely. Once they are offline they can not be remotely controlled.

Light bulbs are not that smart. It is probably best for the homeowner to replace them with dumb bulbs and take the smart bulbs when they leave. It is the same with smart outlets. Once they are unplugged they are stupid. I have two different types and they all have reset buttons.

If for some reason a homeowner comes in possession of smart home devices that are out of control there is always help online through the manufacturer. They know even more than your Facebook friends or the not-always-friendly folks on Nextdoor. There are also numerous free guides on the internet that are actually pretty good.

It is nice though to have passwords so that devices do not need to be completely reset. Having the code to the garage door opener is nice too but they can also be reset.

If I bought a home that had smart devices I would ask for the passwords as a condition of closing. I would also reset those passwords as soon as I took possession of the house. I would remove any device that I could not control or reset. Problem solved.