Interest rates are in the news again because they went up and so did mortgage interest rates. I think the sweet spot that makes purchasing a home doable is about a percentage point lower than what we are seeing today.

I can’t see myself borrowing money to buy a car, and I definitely wouldn’t use one of my credit cards for anything that I could not pay for in the next 30 days or so. As for housing, I suppose if I could buy a house for less than what I was paying for rent I would buy one. If not I would wait until rates get at or below 6% but 5.5% would be much better.

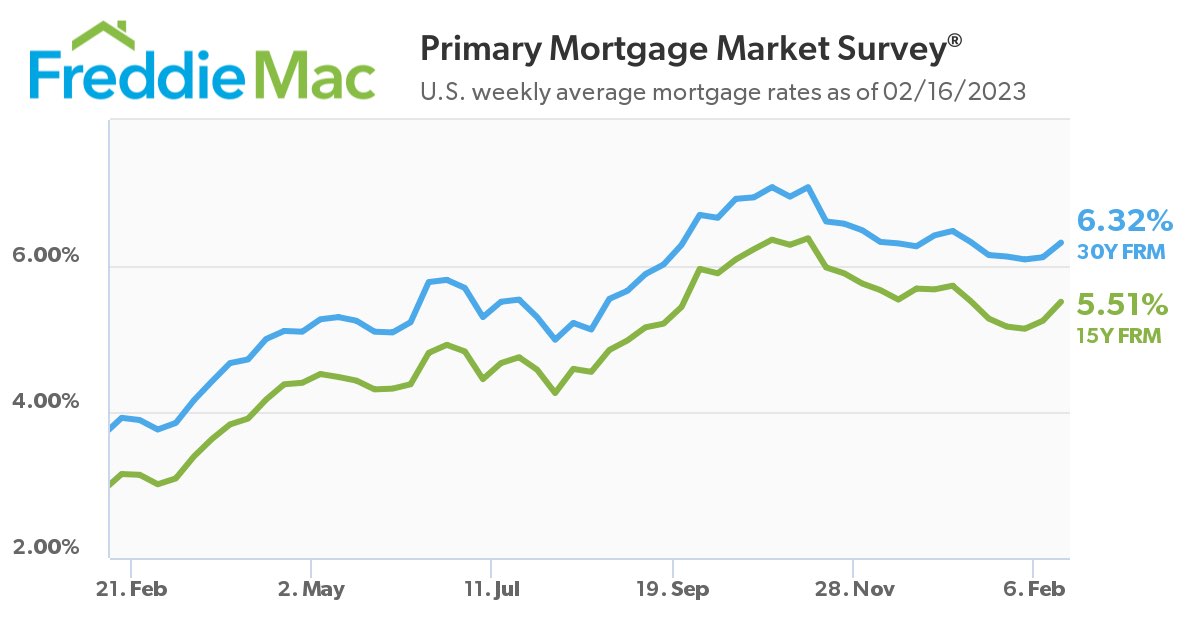

If you look at the chart below, it shows that rates were recently higher. They were over 7% last November. When the rates got closer to 6% there was some cheering but if you ask me, which you didn’t they were too high at 6% considering the price of housing and everything else.

Higher interest rates are driving up housing costs when housing is already unaffordable for many. This might be a good time for consumers to put a hold on any discretionary spending.