Last week I was asked to look at a house for an estate. The relatives wanted a price opinion. I pulled the Ramsey County property tax record, and found the estimated market value to be $489K. My opinion of the market value based on the recent sales of comparable homes in the area, and a close look at the property, came to $320K, or less.

Last Friday Ramsey County tax statements for 2008 arrived in the mail. I got calls from two of my neighbors asking me what I think the market value of their homes are. Both home owners feel that the counties estimated market value is too high, and they might be right.

I did a little searching through the tax records and compared the estimated market values with the actual sale prices of the homes and here are some examples of what I found:

A home that recently sold for $206K, valued by the county at $177K.

I found a condo that sold for $169K valued by the county at $230K, and another that sold for 135K in July, but is valued by the county at $222,900. A home on St. Clair avenue recently sold for $169,750, the counties estimated market value for 2007 is $264,900, and for 2008, the counties estimated value is $195,600. Still too high, it won’t go up in value that much next year.

There is one house in the area that was sold in early 2006 for $329K, yet for 2007 the estimated market value is $271? The new owners did not pay too much for the home, it could easily be sold for more this year.

These are not a few isolated examples, they were easy to find by randomly selecting homes that were sold in the last year. I imagine from the counties point of view it all averages out, but when I look at the tax records and the estimated market values of homes in St. Paul, they don’t make sense.

I looked at the back of my property tax statement and there is a definition for estimated market value, and it is as follows:

"Line 17: Estimated Market Value – The assessor estimates the

"Line 17: Estimated Market Value – The assessor estimates the

value for which your property would likely sell on the open market.

State law requires assessors to value property at 100% of market

value."

The county tax record also contains a limited market value and apparently that value also affects our property taxes, I think . . maybe . . . somehow . .

"Line 18: Limited Market Value – Limits how much the taxable value

"Line 18: Limited Market Value – Limits how much the taxable value

of certain properties can increase, with the exception of new

improvements. The value is limited to the greater of: a) 15% increase

over last year’s limited value or, b) 33% of the difference between this

year’s estimated value and last year’s limited value. This only applies

to agricultural, residential, timberland, or noncommercial seasonal

recreational residential (cabins) property."

Does "limited market value" make any sense what so ever?

This is the value that determines what your Ramsey County property taxes will be:

"Line 23: Taxable Market Value – This is the value that your property taxes are actually based on, after all reductions, limitations, exemptions and deferrals. Your 2007 value, along with the class rate and the budgets of your local government, will determine how much you will pay in taxes in 2008."

"Line 23: Taxable Market Value – This is the value that your property taxes are actually based on, after all reductions, limitations, exemptions and deferrals. Your 2007 value, along with the class rate and the budgets of your local government, will determine how much you will pay in taxes in 2008."

According to the Minnesota Taxpayers Association, this is the formula for figuring property taxes, again there is no explanation of how market value is determined:

"Your Property’s Market Value X Class Rate(s) X “Tax Capacity” Rate —

"Your Property’s Market Value X Class Rate(s) X “Tax Capacity” Rate —

Market Value Credit (0.4% of MV up to $304 in ’07, phased out > $76,000) " . . wow! transparency!

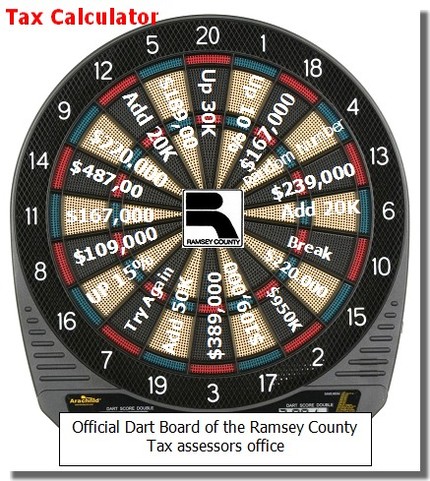

I am sticking with my story about the dart board. I think that is how values and taxes are really determined. Even if the county does reduce the estimated market value, they can increase the taxable market value resulting in a tax increase. My neighbors estimated market value went down by 12%, yet their taxable value went up by 25% during the same period, and their taxes went up by 33%.

Honestly the limited market value, and the taxable market value make no sense what so ever. There is a system in place for appealing your tax value, and here is a link to it: http://rrinfo.co.ramsey.mn.us/docs/tips/valuenoticeback.pdf

I have heard of people appealing but have never heard of anyone winning, but I like to think that sometimes they do. Most people don’t take the time to complain. There is informati0n about the county budget and about where the tax dollars are spent but how the county determines value remains a mystery. There are truth in taxation hearings every year. They don’t accomplish anything but are fun to watch.

At the very least someone from the county should be able to explain how the Ramsey County assessors office complies with the state law that requires the estimated market values to be 100% of the market value. Market value is part of the equation . . . somehow, I think. It seems like a silly law. How is the county going to determine market value? In many cases they don’t have correct property descriptions. Square footages, year built, the number of rooms and even the number of stories are wrong for many of the properties in Ramsey county. I see it all the time, when I look at tax records as I work with buyers and sellers.

Here are links to the people who can answer questions about property taxes: The tax assessors office and Ramsey County Commissioners. The commissioners don’t calculate property taxes but they are elected by us.

The taxes on our home have doubled in five years, with an expected increase of 17.5% for 2008. The dollar amount does not seem unreasonable, but it is getting there. It is the alarming rate of the increases, and the over all fairness and accuracy of the system that I am having a problem with. OK I am done! . . after I send this post to our commissioner.

We bought our house in April for 182k and Ramsey County had it valued at 220k. So we talked to them and they came back out and re-valued the property down to 189k. So it does work, at least sometimes.

-Josh

Josh – nice to hear a success story, thanks so much for the comment.

I agree with you 100% Teresa! I always try to educate buyers on how far off the county can be…

This is something that will definitely come up again in early 2008 when the assessed values for 2009 are provided. Unfortunately there isn’t anything that can be done for 2008 taxes at this point since those values were established last Spring.

Right now I believe that the county has me assessed about 8% higher than I could receive at sale… if it goes any higher I will have to fight it.

Teresa,

Great post. It makes me think that one of the after shocks of the housing crisis will be shrinking state and local government services due to the reduction in tax revenues. The stress that that will put on many of these government entities could be severe. I am going to write my local commissioner here in Marietta, GA to ask specifically about this problem. It seems that the only recourse will be to increase our taxes as the basis on which taxesa re determines shrinks. Ugh! Ugly thought!

There’s nothing good about property tax, in my opinion. It starts with the idea of “Market Value”, which is nearly impossible to determine accurately without actually selling the place. From there, good records about the actual size and condition are needed, and that’s just about as impossible (apparently).

Funny thing about it is that it started out as a “reform” way back when William Pitt the Younger was Prime Minister and were were a bunch of colonies. It was a radical improvement over a “Poll Tax”, where everyone pays the same amount, because it only taxed people who owned land. Well, now that we have decided everyone owning land is a good idea, it seems about as dated as English Rule.

There have to be better ways of doing things in this “Information Age”. If I thought the problems T identified were fixable, I might think otherwise. There just doesn’t seem to be a way to fix them and come up with something truly “fair”.

Aaron – your attitude is similar to mine. I have not quite hit the panic button on my own taxes but am getting close.

Christine – our governor vowed not to raise taxes, as a result we are getting tax increases from several directions as government agencies look for ways to make up the deficit. An increase in our state deed tax is one example of the kind of hidden regressive way taxes are raised.

Erik – the very first step to coming up with a solution to any problem is identifying it and of course acknowledging it’s existence. The first step would be updating property tax records. The second is using the information to put a value on homes in much the same way that Realtors and appraiser do. We have a lot of data to work with, because this is the information age.

Teresa – Love the creativity of your post! Property taxes are and will be a continuing source of frustration for both the homeowner and the county assessor’s offices. Here in Indianapolis, they won’t even talk to you unless the assessed value is off by more than 10%.

Paula – I think the way the county determines value is much more creative than my post, but thanks. That 10% rule seems kind of harsh.

Hi Theresa, I’ll be putting my home on the market soon. It’s in a nice neighborhood (good for me) but is the original old farm house of the area so there are no comps (bad for me. My tax info is all there is to help establish price. My estimated market value is $203K, my taxable market value is $150K and my property description doesn’t match where I live. My taxes will increase over 14% for 2008. It’s increased in double digits for the past several years. By escalating the estimated market value taxes can be raised without appearing to raise taxes. No wonder the real estate market is in such a fix and so many of us are left asking what happened here?

Jo Anne – In most cases you can not use your estimated market value to determine what the sale price of your home will be or to set the sale price. Not having comps does make it tough so in those cases we have to compare to homes in the immediate area that are the same size and have similar amenities.

Call the county and clear up the discrepancy between the description and the location. It is easy to do.

My taxes are going up 13%, and they have gone up in double digits every year and are double what they were five years ago. There are no good comps for my home either as it was built before MN became a state. It is unlikely that we will ever sell it so I guess someone else will have to figure it out.

As what happened here . . that is a whole seperate blog post. 🙂

I bought a house in October in Ramsey County. The county has it valued at $220k. I paid $180k and filed an appeal when I was at the government center to file my homestead documentation. Ramsey County will not re-appraise the property unless the difference is at least 5% and $10,000 difference.

I hadn’t heard anything from the County in about a month, so I called to inquire and they said it can take up to 90 days for the new appraisal to happen.

Matt – I have had some contact with the county becasue of the post and the word I am getting is they are busy and the appraiser works very hard. 🙂

This appraised value is nuts, especially in 2008 considering the actual declining property values. The assesors certainly do not consider the declining property values. For me this has gotten so much out of control that I am going to be forced to sell and move. I here that Florida is a tax me less state, at least much less (over all) that MN.

great post. The taxes in Ramsey are really out of control. Frustrating and gives me a powerless feeling.

Anyways, if the assessment is near market value, I guess I can just accept it.

I’ve been looking at many properties around the neighborhood and I find it very interesting that property payment stubs that indicate payment by mortgage company had tax decreases along with a majority had 2009 estimated market values decreased. While every property stub that did not have this paid by statement had property tax increases and a majority of the property values stayed the same as 2008. What gives… why the extra penalty for those who paid off their mortgage responsibly. I guess they need someone to ripoff. Ramsey county property taxes are a joke, same houses located on the west side of the street have same or increased values while east side of the street all have lower values and have decreased in value. All corner lots have had values remain the same while homes in the center of the block have a large drop in value. All this even after the assessor was out a couple years ago. I firmly believe in your explanation of the assessors dart board.

FYI – take a look at 2299 co.rd H in Mounds View a commercial property that expanded to two large buildings as a sandblasting company currently listed as warehouse. Build value estimated for 2009 is down to $1,000 when the 2008 value was over $500,000 but the overall value of the property increased to over $900,000 (land tax must be less than structures?). Someone is dirty, it’s no wonder Minnesota has such a budget problem. Maybe they should require a mandatory turnover in these goverment positions so a new regeim can try to fix the errors or corruption.

http://rrinfo.co.ramsey.mn.us/public/characteristic/index.aspx