Last week is one that I won’t soon forget and it will be a long time before I have any faith in our national or state government. If elections were held today I would be hard pressed to vote for anyone who is currently in office but I will cross that bridge when re-election time comes around again.

The dept ceiling crisis, lowered credit rating and high unemployment numbers will impact the housing market. We have already seen the negative impact on the stock market.

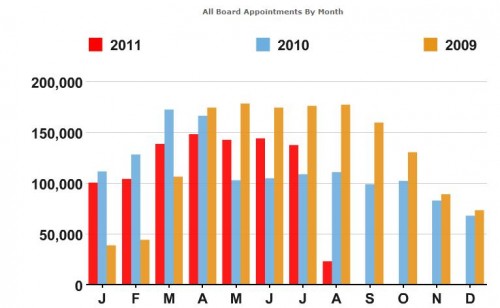

This chart below shows how many appointments were made for private showings of homes listed for sale in our MLS and the data was created with the report writer in Book A Showing which is the nifty appointment scheduling system built right into our Local multiple listing service. I don’t know the exact correlation between showings and sales but there is a correlation. When home showings go up sales follow.

The chart for 2011 paints a healthier picture of the local real estate market this summer than last. After the tax credits in 2010 expired the number of home sales and home prices both went down. Real estate here in Minnesota is seasonal and it is normal for home viewing and sales to be the lowest in December and January.

If you have a home to sell I can tell you that homes in the area sell every day. We will continue to sell homes and there are always buyers.

Interest rates remain at historic lows which makes owning a home more affordable than it has been in a long time. For some owning is now cheaper than renting. The latest economic news and turmoil have already had an impact on mortgage interest rates, they have gone down slightly. Talk to your lender but today may be a great day to lock in.

I agree that there are many good deals to be had especially concerning low interest rates. I would love to see your take on the government possibly allowing the banks to rent foreclosures versus selling them off.

-Dan

That is easy. I absolutely hate the idea and I believe it has to do with government backed loans which makes it even worse.

I have so many renters that are paying more a month than it would cost to have a mortgage payment but don’t have the credit to get a loan.