Thinking about property taxes is not much fun and most people would rather not pay them at all but we all know that the money we spend provides services that we can’t live without. Imagine not having a sheriff, or a jail?

I get calls and requests from people for property valuations, because some home owners don’t believe the county assessors valuation to be accurate. What I do when I put a price on a property is determine how much it will likely sell for in todays market. These days my valuation is a moving target. Prices are not all that stable at the moment.

There has not been a time in my memory when the valuations by the county tax assessor closely matched the actual sale price of a home. In past years people who bought a home received a property tax hike the following year because the valuation was lower than the sale price and so the valuation was raised to match it. I am not sure if they do that when the county valuation is higher than the sale price.

A Dakota county resident called me yesterday and made the statement that property values have gone down nation wide, yet the tax assessor estimated that his property went up in value by 2.9%. I explained to the caller while it is true that property values have gone down nation wide in the last year, property values have not gone down in every county, town or neighborhood in the last year. In some areas and neighborhoods property values have gone up. Real estate is very local.

Talking to a Realtor or an appraiser about the value of your property might not help with the county valuation. It would be best to talk with the county tax assessors office and get the details on how to challenge the county valuation.

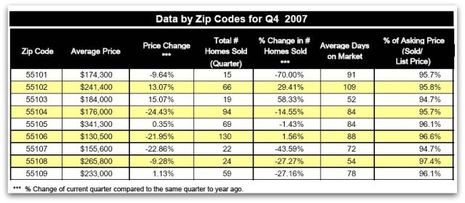

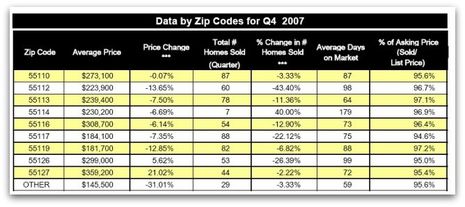

Here are some charts that show what I am talking about when I say that real estate is local and property values have not gone down on all property. The charts are by zip code for Ramsey County MN and they compare 2006 and 2007 fourth quarter real estate sales and average prices.

Click on the charts to make them larger. They are from the Regional multiple listing service which is our local MLS, not to be confused with mlsonline which isn’t the MLS at all.

Also see How Ramsey County Determines value

Here’s a radical reform:

If the County says your home is worth “X”, then they should be prepared to buy it for 80% of X, meaning they’d get a huge bargain, right? I mean, as long as the valuations are in line with the market no one would ever take them up on it, would they?

(Note: I’m not really serious, but it’s a way to illustrate the problem)

Great Post Teresa, Things here in the Brainerd area have really gotten out of control on accessed values and current market values. I recently sold a home that had an accessed value of over 285K and it and closed it for a purchase price of 100k or so less. Hope things get readjusted soon.