I never get a tax refund. As an independent contractor I pay income taxes quarterly. My payments are based on calculations from last year. If I underpay I pay a fine and if I over pay I apply the overpayment to my first quarterly payment of the next year which is due on April 15th.

I just want to impart two tax tips which isn’t the same as tax advice because legally I can not give tax advice:

1. There are tax deductions for homeowners BUT only for those homeowners who have enough deductions so that they can itemize and will take the standard deduction. See the IRS web site for tax rules for homeowners. It is the interest on the mortgage that is deductible. The more money you borrow the bigger the deduction.

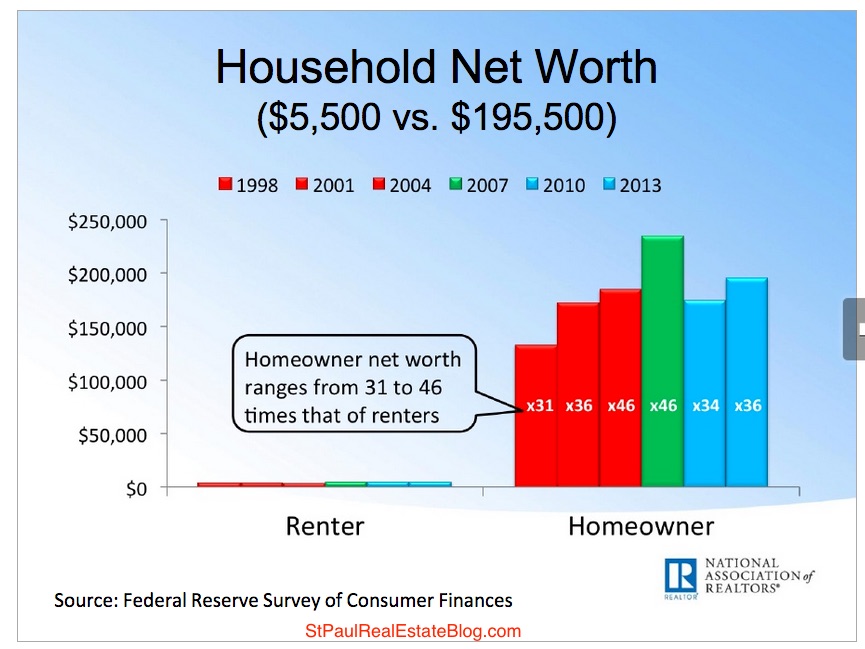

Don’t feel let down because you bought a home just for the tax deduction. There are a lot of other great benefits to home ownership including the ability to build greater wealth than you could has a renter.

2. If you need to keep receipts for tax deductible expenses take advantage of the camera in your phone.

For a couple of years now I have been storing my receipts in Evernote. I create a tax notebook in Evernote each year and when I get a receipt I take a picture of it and store in in Evernote. It only takes a second and I don’t end up with a big old bag full or receipts at the end of the year.

If I were to provide a third tip it would be to my neighbors and that is to do your taxes now. I’ll always remember the year I spent that beautiful weekend in April doing my taxes. It was during the best weather of the year because it was those first few nice days. Everyone went out to play and I was stuck in my offices gathering information and adding numbers and filling out forms. 🙁