You may have gotten a letter in the mail from a couple or a Realtor. The couple is looking for a home in your neighborhood. The Realtor has clients who are looking for a house in your neighborhood or a house like yours.

In most cases, this isn’t a scam. There are people looking for every type of house in every neighborhood. The Realtor is looking for listings as we all are. If your house goes on the market it will sell in a couple of days. There will be multiple offers too which is a good thing.

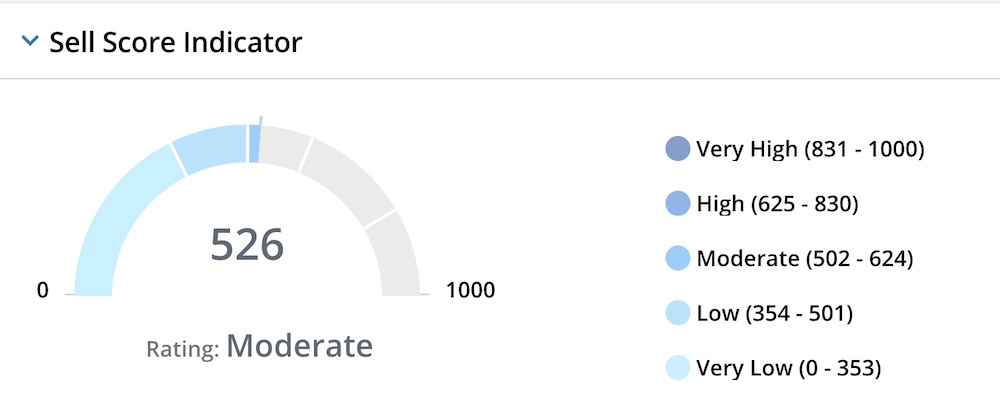

Every homeowner has a “sell score”. The sell score is used by Realtors to determine if a homeowner is likely to sell soon. If you would like to know what your sell score is ask a local Realtor. I looked ours up. It was very high the last time I checked and now it is moderate.

Properties with a Very High Sell Score (831+) represent the top 5% of properties most likely to sell and are 2.6 times more likely to sell than the average property.

There are times in people’s lives when they are more likely to buy or sell their primary residence. Older people are less likely to move than younger people. The housing market right now is unusual and unprecedented. I don’t have a lot of faith in the sell scores but if I were sending letters to homeowners I could use it as a guide.