The Saint Paul Area Association of Realtors just published a report about the state of the local housing market. They get the numbers from the same place that we all get them from the Regional Multiple Listing Service, which is deemed reliable but not guaranteed.

distressed

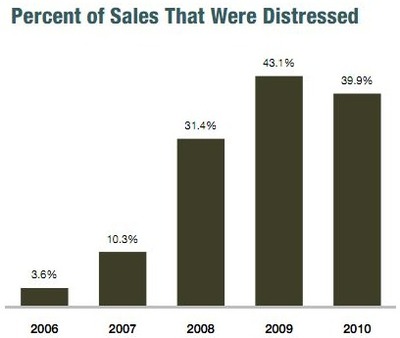

The report indicates that there were 23% fewer distressed* homes sold in 2010 than there were in 2009. Someone messed up on the math because I come up with an 8% difference. Great care was taken with the numbers. They were not rounded. 2010 looks better at 39.9% distressed properties than it would at 40%.

The numbers do not look encouraging, other than the fact that the distressed properties are selling. Prices went up slightly in 2010 but that is up from a low that we have not seen in at least a decade. There is no doubt that this is a good market for home buyers and investors with the low prices and low interest rates. Unfortunately the pool of eligible home buyers has shrunk and will continue to shrink as people are unemployed, underemployed or have been through a foreclosure in recent years and do not have a good enough credit rating to qualify for a home loan.

It is possible that a year from now when we look at the number of distressed properties on the market in 2011 the number will be higher than it was in 2010 reflecting a higher number of foreclosures. We forget that the “robo signing” scandal caused some large banks to hold off on putting foreclosures on the market. They needed to make sure that they actually own the homes they repossessed.

The housing market is what it is and as always there are opportunities for some but not for all.

*distressed is defined as properties that are bank owned or short sales that need bank approval

[…] This post was mentioned on Twitter by Teresa Boardman and Miss Shannan Paul, My REALTY. My REALTY said: Distressed properties still plentiful: The Saint Paul Area Association of Realtors just published a report about… http://bit.ly/gBcgbj […]

I would anticipate robo-signing likely had minimal impact on Minnesota foreclosures since most are foreclosure by advertisement. I agree the foreclosure market will continue but as long as distressed sales are declining and days on market decreasing, this will be a positive for the local economy. Especially given the unemployment rate decreasing to 7%. It would also be interesting to see the trend by Area specifically as my guess is that the foreclosure activity is still concentrated in certain regions of the cities.

The robo-signing could wind up stalling the bulk of the foreclosure market. Imagine what a mess it would be if a few enterprising class action attorneys entered the fray.

They could fight to re-open foreclosures that were already settled and either sue to get the property returned or, at least, a large cash settlement out of all those lenders that we were forced to prop up with borrowed Chinese T.A.R.P. funds.

Hopefully Minnesota will not be harmed as much as Florida, Arizona and Nevada. Guess we’ll see soon enough.

I think as in the 30’s the banks should rent back some of these properties and put them on the market a little at the time.

I’ve got one lender who is having us manage and rent their inventory of foreclosed houses. Slowly, they are selling the most attractive ones and holding onto the smaller outdated homes that will sell for very little money. Some of the properties cash flow for the bank vs. what they could sell them for in today’s market.

I think that approach sure as heck beats allowing a vacant home to become a blight on the neighborhood for a few years before it gets through the legal and bureaucratic process and finally is sold.