First time home buyers are often surprised when they find out about closing costs. Those pesky fees are in addition to the down payment. Lenders will provide detailed information about what those costs are but here are a few examples:

First time home buyers are often surprised when they find out about closing costs. Those pesky fees are in addition to the down payment. Lenders will provide detailed information about what those costs are but here are a few examples:

1. Loan origination fee

2. Appraisal fee

3. Pre-paid homeowners insurance.

4. Property taxes prorated from the day of closing and for the rest of the year.

5. Mortgage registration tax

6. Pre-paid interest and taxes (prorated from the day of closing)

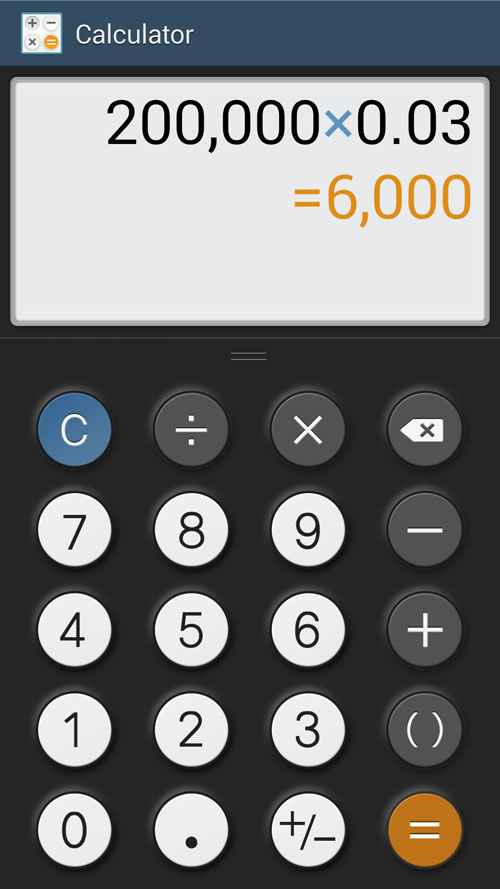

Typical closing costs in Minnesota are about 3% of the purchase price which is usually not the same as the loan amount. In addition to closing costs, most home buyers will make a down payment. The down payment can be as little as 3%. There isn’t any truth to the rumor that home buyers need to put 10 to 20% down to buy a home. There are some down payment assistance programs too.

Home buyers often ask sellers to pay their closing costs. Typically that means that the buyer borrows 3% more and those funds are applied to closing costs. I encourage buyers to do the math and understand that the closing costs come off of the seller’s bottom line. I encourage sellers to pay attention to the bottom line and I let them know that paying the buyer’s closing costs is common and often necessary.

To estimate closing costs the lender needs to know what day the closing will be held on and will have an exact figure available to the borrower 3 days before the closing. The lender will provide a good faith estimate shortly after the loan amount is known. Closing costs should never be a surprise.

Closing costs are generally lower in Minnesota than they are in other parts of the country.

can the closing costs be added to the agreed upon price? that way it doesn’t come out of the seller’s bottom line? example: agreed price is $200K. with a 3% closing costs buyer requests loan for $206K. sellers still gets their $200K and the remaining $6K goes to closing.

Absolutely! The only catch is that the house has to appraise for at least 206K.