It is Monday and I have some real estate numbers for St. Paul Minnesota because real estate is local and I like numbers.

The numbers used to make the chart came from the Northstar MLS and are deemed reliable but not guaranteed. I did not take any of the numbers I just borrowed them.

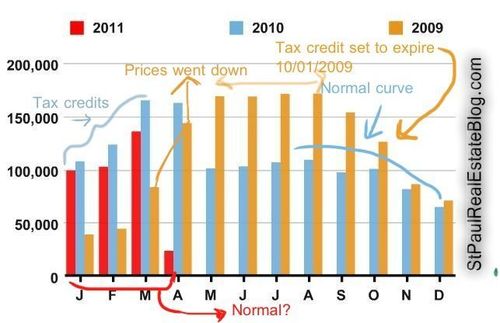

December is the slowest month of the year for home sales and prices are usually the lowest of the year. Median prices in St. Paul were $104,500 for December 2011.

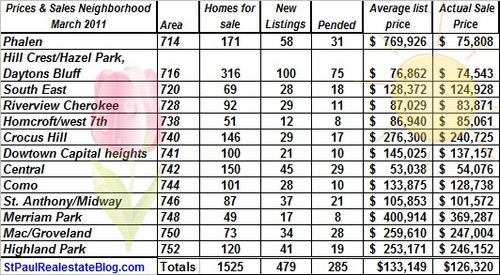

For the first time since in many years but I do not know how many there was more buying going on in our market than selling. The number of pending sales is higher than the number of homes that were listed. This is great news for home sellers.

December 2011

The inventory of homes on the market is very low and buyers are having a hard time finding that perfect home. I have been watching every day for new listings for my buyers which is something I have not had to do in years.

I anticipate an increase in homes on the market and an increase in buying activity because we almost always see more activity in January than in December.

For more numbers like these please see local numbers and market conditions.