For some owning a house is a short-term kind of thing. When a mortgage is involved short term home ownership is a win for lenders. The interest on mortgages is front-loaded making interest payments the highest in the first month.

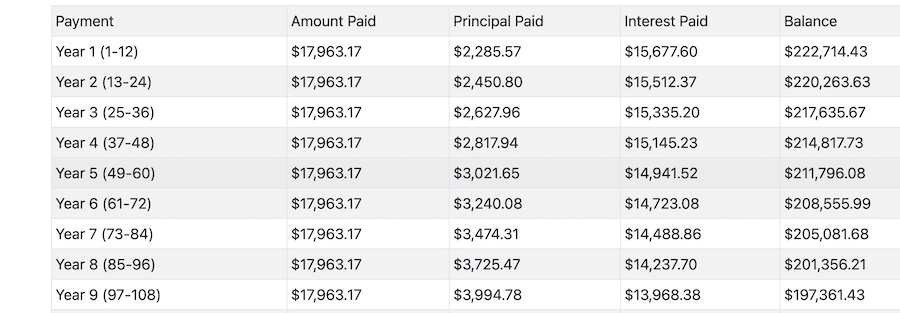

In fact, on a 7% 30-year mortgage with a 10% downpayment, it takes about 20 years before the monthly interest payment is lower than the monthly principal payment.

If the house is sold during the first five years of the mortgage the lender makes a lot of money. If someone else buys the house and gives a 30-year mortgage the lender makes even more money.

I support home ownership wholeheartedly but I often discourage home buyers who believe they will need to sell in a few years. Homeownership, or should I say mortgage ownership is more of a long-term kind of thing.

Yes, interest rates matter. In the example above the borrower pays over 76,000 in interest during the first five years and $13,203 in principle. Sure home prices are rising and the buyer will have some equity after five years but they also had closing costs on the loan, a down payment and there will be closing costs and other expenses related to selling the house.