The great recession is indeed over but I can see remnants of it here and there. Home prices are still lower than they were before the recession. For a time Realtors® were talking about “rising affordability”.

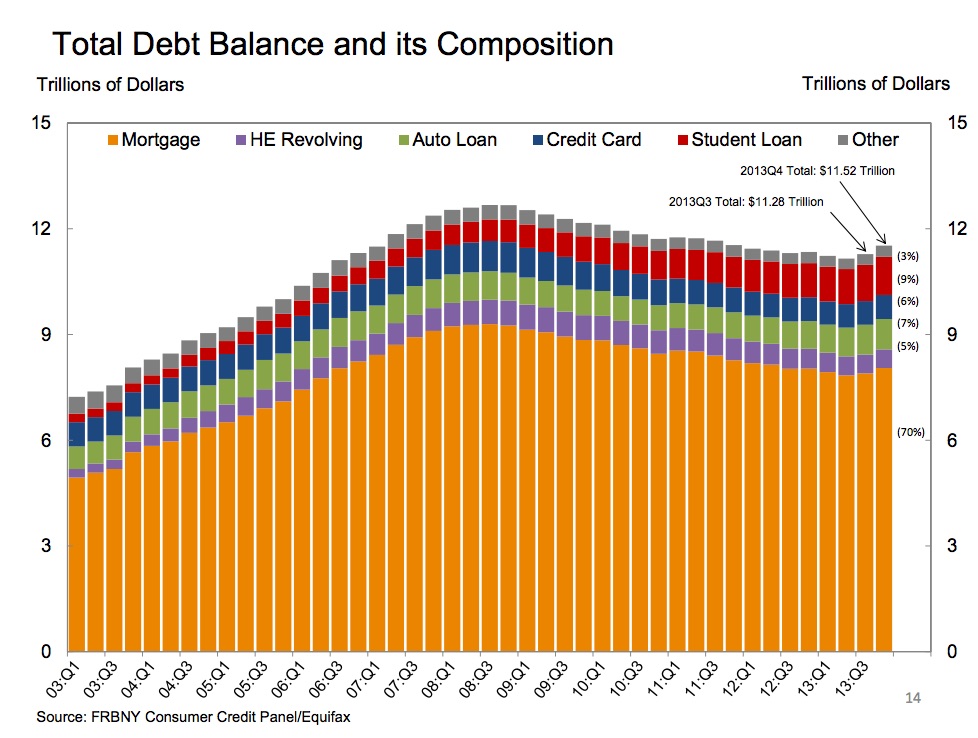

Now post recession consumer debt is rising again. Student loans are taking a bigger chunk. People incur a ridiculous amount of debt for bachelor’s degrees that will help them land jobs that will pay 40K a year. As housing prices went down college tuition continued to rise to the current stratospheric rates.

Real estate is an asset which makes the debt different from an auto loan. Theoretically when a person buys a house they can turn around and sell it a few years later and pay off the debt. If a homeowner hangs onto the home long enough to pay off the loan they may be able to sell it and get back every dime they spent on mortgage payments.

A car is more of a liability. We take out a loan on a shiny new car and drive it off the lot and it is already worth less than we paid for it.