Yes, the taxes are done. I remember when my dad was 90 years old and one of his last requests was about his income tax return. He reminded me that it needed to be prepared and filed. Few things in life cause as much stress as income tax compliance. There may be a penalty if the filing deadline isn’t met and there are underpayment penalties too.

Most American workers have taxes withheld from every paycheck. The IRS knows exactly how much W2 workers make.

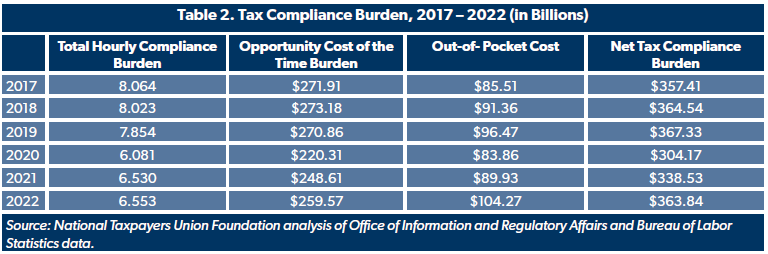

According to the National Tax Payers Union taxpayers spend $104 billion a year on out-of-pocket expenses associated with preparing and submitting tax forms. Some entail basic costs such as making copies of financial statements, receipts, or forms.

The Office of Information and Regulatory Affairs (OIRA), found that complying with the tax code in 2022 consumed 6.55 billion hours for recordkeeping, learning about the law, filling out the required forms and schedules, and submitting information to the IRS.

For those of us who are self-employed, record-keeping is a daily part of running a business. It isn’t just for determining profit and loss it is all about having everything we need at tax time. Income tax compliance costs time and money, time that could be spent making more money.

Taxes are not withheld from any of my revenue. I have to calculate how much I owe and make payments. If I estimate too high and pay too much, it is best to apply what could be a refund to the next year’s taxes. If I pay too little I have to write big checks. I know plenty of people who are interested in self-employment but believe that their taxes would go up or that taxes make self-employment too risky.

I keep records as I go and almost everything is automated it takes me about three hours to gather all of the information I need to file an income tax return. I used to have to spend entire weekends working on income tax returns. Usually, warm sunny spring weekends when the birds are singing and the flowers are blooming.

Once I have all of the forms and documentation put together I pay a professional to do my taxes. Yes, I can do them myself but hiring a pro takes some of the stress out of the process. I learn something new each tax season and that helps me make better choices throughout the year. I actually mostly understand my taxes.

As for using tax preparation software, no thanks. I have used it in the past. I would call it a “bad experience” all the way around.

Supposedly the IRS is understaffed but they always have the time and the staff to find small errors in the tax returns that come from small businesses. I am not going to argue over a few dollars even if I don’t owe it.

When I am on my deathbed bed I am not going to worry about taxes. If I die owing taxes I am OK with that.

In some countries, taxes are paid online using a simple free form. In the U.S. taxes are a multi-billion dollar industry that isn’t going away anytime soon. Neither are the 74,608 pages of U.S.tax code or the 79,000 IRS employees.