The final step in the home buying process is a closing. Here in Minnesota that means the buyers and sellers meet at the title company and sign a bunch of documents. The money to purchase the home is wired to the title company, checks are cut and the buyer walks away with house keys and a garage door opener and the sellers walk away with a check.

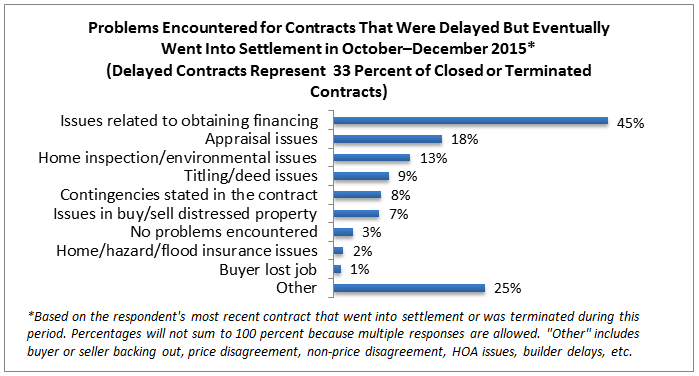

Closing are on time more often than not but they can be delayed and the most common reason for the delay are issues with the buyers financing. When buying a home I encourage buyers to ask for a closing date that is at least 45 days after the date of the offer for any buyer who requires a loan.

The National Association of Realtors conducted a nation wide survey of delayed closings. Issues relating to financing can include problems with the house or with the buyer. Underwriters sometimes require repairs especially if the buyer is using FHA financing. Other times the buyer is slow to respond to requests for information needed for final approval. Problems with the appraisal occur when the lenders has the home appraised and the value is less than the amount that the buyers have offered.

Not all delayed contracts actually close. Sometimes buyers and sellers have a disagreement and can not come to terms and as a result they cancel the contract. Occasionally buyers and sellers come to an agreement on price and then one party or the other changes their minds. I had that happen on with a seller I was representing last year.