St. Paul is the first city in the US to enact a rent control policy that caps rent increases at 3% a year. Even if one tenant leaves and the unit is vacant for a few months and another tenant moves in. It doesn’t matter if property taxes increase by 11% as is the plan this year. In the short run, this is all very good for people who rent. I can understand why the referendum was so popular.

People who are buying multi-family homes and who plan to charge rent should make sure they know what the rents are currently and when they were last raised. They may also want to consider buying investment property just outside of St. Paul.

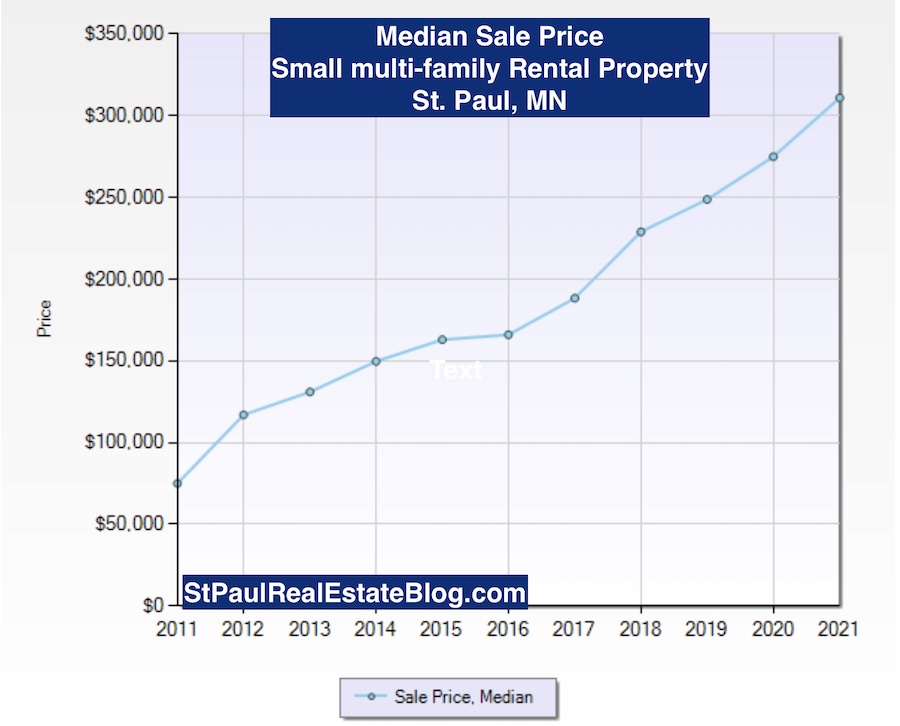

Rents tend to get raised as property values go up. No one really knows how that will work. As property values continue to rise at a rate of more than 3% a year it is hard to say how this is going to work. I’ll be watching the numbers closely in the coming months. The 3% yearly cap on rent increases does not go into effect until May 2022.

Eventually, maybe more housing will be built. A higher supply of housing units will result in lower prices. Right now at least one large project has been put on hold because of the rent control ordinance. All other cities that have rent control make exceptions for new construction. The mayor says the ordinance can be tweaked others in city governance say that what passed by vote stands.

The current supply of housing is tight which is leading to higher costs and of course, those pesky property tax increases aren’t helping either.

The numbers used to make the graph are from the NorthstarMLS and are deemed reliable but not guaranteed.