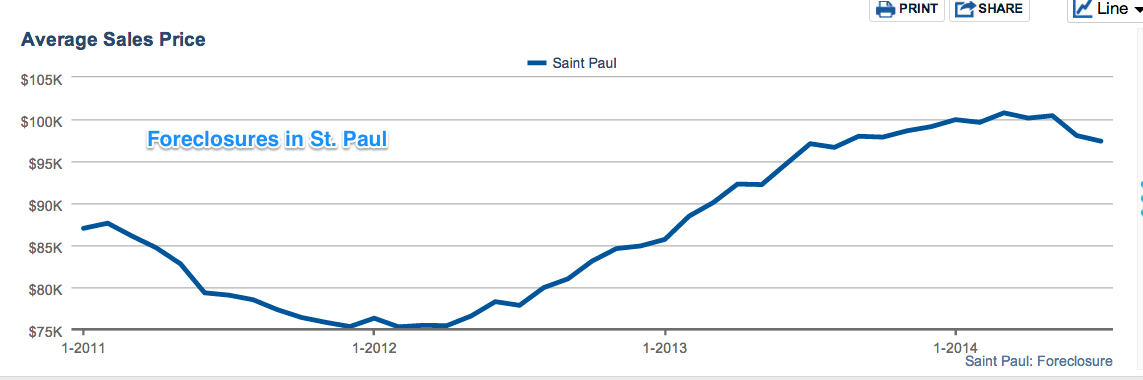

Home prices hit a low in St. Paul in 2009 and then after the tax federal tax credits expired in 2010 there was a new low that hit in 2011. During that time more than 30% of the homes on the market were in some stage of foreclosure and I swear at the time it seemed like we could not give the foreclosures away. It was a buyers market.

There were some smart investors who bought up foreclosures when no one else wanted them. They fixed the houses up all pretty and put them on the market and sat back and watched the bidding wars last year and this year too.

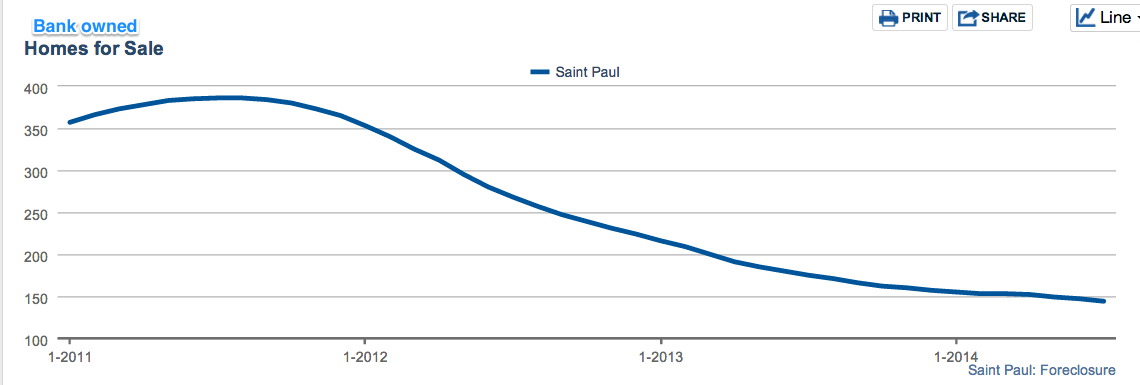

These days there are not many bank owned properties on the market, in fact I think there are 6 in St. Paul right now and maybe about 150 properties that we call distressed in that they are likely to become foreclosures.

Now that the economy is a bit better and unemployment rates are lower and home values have been going up there is a whole new interest in buying distressed property. There are some deals and some opportunities out there but the people who had the money and were willing to take the risk who bought when the market hit bottom are the people who came out ahead by buying foreclosures.

2011 were the good old days for buying foreclosures and now is a great time to re-sell them.

The numbers used to build these graphs are from the NorhstarMLS. The data is deemed reliable but not gauranteed.