If you have ever sold a condominium you know that there are certain documents that the home buyer is entitled to. There is a financial statement and the rules and more. Most associations charge for these documents and occasionally the fees are obscene. In this case I ordered the basic documents that the association should have on file electronically and be able to email quickly.

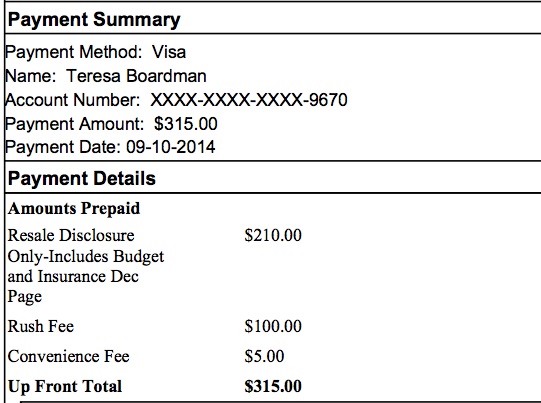

Not only did I get charged an outrageous amount for electronic documents but I also had to pay an extra $100 to get it in a couple of days, I don’t even want to know how long it would have taken if I had paid a mere $210. Thee was an extra fee for using a credit card too and I think that was my only payment option.

To make matters worse an additional document was required by the lender above and beyond what I had already paid for. The lender asked for the document one day after the closing was supposed to have happened because all too often life hands us crappy mortgage/banks that don’t do “service”.

To make matters worse an additional document was required by the lender above and beyond what I had already paid for. The lender asked for the document one day after the closing was supposed to have happened because all too often life hands us crappy mortgage/banks that don’t do “service”.

The document costs $75 but in this case they added and extra $50 for filling out the document that the lender provided instead of simply sending the generic form. I’ll do the math for you. The total comes to $230 if we add the rush and convenience fees. The questionnaire is a simple form the most condo owners could fill out themselves but of course lenders require that it be filled out by a management company or someone on the board of directors for the association. I suppose if I had filed it out myself I would have made up the answers because I can.

The fees are being charged by a professional management company that was hired by the homeowners association. Professional management of association is fairly common. The money does not go to the association but to the management company. Sure they have to make a profit but they should find some way to provide services that are worthy of their obscene fees instead of charging for PDF documents that cost almost nothing to store and to email.

For those who belong to condo associations or are on the boards of condo associations it might be a good idea to check into the fees for documents. I can tell you for sure that the rates charged in the example above are higher than average and from what I have observed the management company isn’t worth it. Homeowners get pretty upset when they see these fees on top of their association dues. Most of the resale documents do not change all that often. The information on the resale certificate has to be updated but it is with information that a condo association has and is responsible for keeping up-to-date.

A few years ago these documents used to be printed and sometimes had to be mailed. Management company employees had to use staplers and they had to collate and put the correct postage on the envelope. They needed to be able to operate copy machines. I can see why they had to charge for all of that.

I recently worked with a self managed association where we were charged $125 for the documents and they were emailed before I mailed a check. We are in a digital age. Documents can be stored in the cloud, kept up to date and can easily be sent to those who need them.

If there are any associations out there who would like me to show them how they can handle these documents efficiently and cheaply just send me an email or call me. I’ll charge a one time consulting fee which can be paid by credit card with no extra fee.