Please play this YouTube video while reading this post. It provides a perfect background for this timely and startling piece of news.

According to Ramsey County, the property tax assessors office of course, the median home price in St. Paul has gone up an average of almost 10% between 2007 and 2008. I found this out from a county document published on the City Hall Scoop Blog.

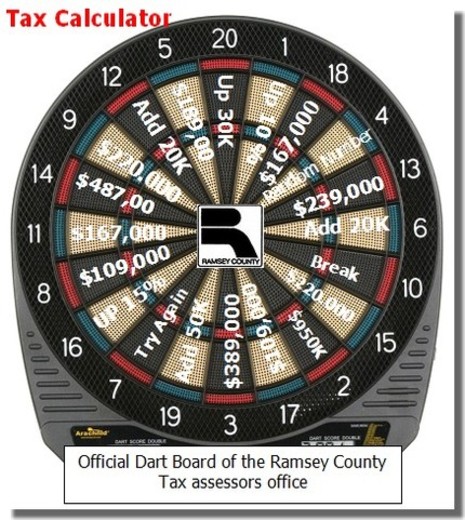

I hope that bubble_up and patient home buyer are both out there reading this. My numbers indicate that values have gone down in some neighborhoods and have increased in others. There may even have been a slight decrease in the median. After I do my math I will apologize for this post if I am wrong. I will deliver a new dart board to the tax assessors office in person along with my apology.

Also see: Ramsey County, How do they determine market value? (It still remains one of the great mysteries of our time)

Thank you for the mention, Ms. Boardman, and I am pleased to learn that the “median taxable home market value,” whatever that is, rose so rapidly in the Saintly City last year. I guess all this talk about foreclosures, subprime mortages, declining home values, and the housing bubble is just hooey, despite that headline in today’s paper saying that Saint Paul “Real Estate Sales, Prices Drop Again”: http://tinyurl.com/2ufdqn . Also, this should mean that local Realtors’ average income is up 10% this year, too, right? Congratulations!

Thanks for dropping by Bubble_up, most appreciated. Not sure how the average Realtor is doing, I guess I am more of an extraordinary Realtor or maybe not becasue my income is down this year. It is that darn condo market. My property taxes did go up by almost 14% though and I think part of it is becasue of the 12% increase in values in my neighborhood. On the bright side I guess I could qualify for a mortgage and refinance and live off of my equity, which did go up so much this year. Not 🙂 Funny I seem to get more sarcastic during the holidays, must be seasonal affective disorder, or maybe my tax statement.

SEASONAL Affective Disorder? There is no “SEASONAL” in your disorder(s)!

Just a little lag in the system, I suppose.

Watch for massive revenue shortfalls in municipalities nationwide. As property prices accelerated beyond underlying fundamentals, these local governments ramped up spending to match revenue, not realizing that it was not sustainable. Not only did they spend all of the bubble-related tax revenue, but they (like so many others) projected continued price appreciation (thus increased revenue) into the future.

Now is probably a bad time to own municipal bonds. That said, after a few waves of municipal defaults, muni bond rates will rise and they may make good investments. Many of these bonds have default insurance on them from ambac or mbia, who are about to have their ratings cut, thus putting the value of this “insurance” in question. If the insurers become insolvent, the ratings on the munis will drop and you can expect a selloff.

On a very serious note, California just did a bond issue and decided to forgo the insurance. That ought to send a clear signal that they don’t see the default insurance as having any real value.

Patient Buyer

Patient Buyer – Thanks for stopping by.

Dear Ms. Boardman: Sounds like you’re entitled to a little sarcasm. Your readers might be interested in this additional information about the St. Paul market, which probably is more pertinent than the somewhat bizarre assessment info posted earlier (warning: it’s a PDF file):

http://www.mplsrealtor.com/Segments/Realtors/The100/Saint-Paul.pdf

Bubble up, I have been publishing these numbers every month and will do so again next week. They are under local market conditions and home prices using the same data that your link it point int to. The county uses the 17 district planning council areas which are different from the 13 St. Paul MLS district. They don’t publish a median price. At one point I explained how to do it and they will be adding it. I plan to include that in the numbers I put up next week.

All the serious stuff aside, a laughing baby is always nice to listen to. It’s one thing that is gauranteed to make me laugh out loud!!

Steve – that was the idea. You can’t listen to that and not laugh. 🙂

Teresa – It is my theory most tax assesors use a similar system for determining value. Love your art work and the baby!

Honestly my problem with this is that we have a Minnesota state law that says these values have to be accurate. I have to obey the law, I think the county should be held accountable.