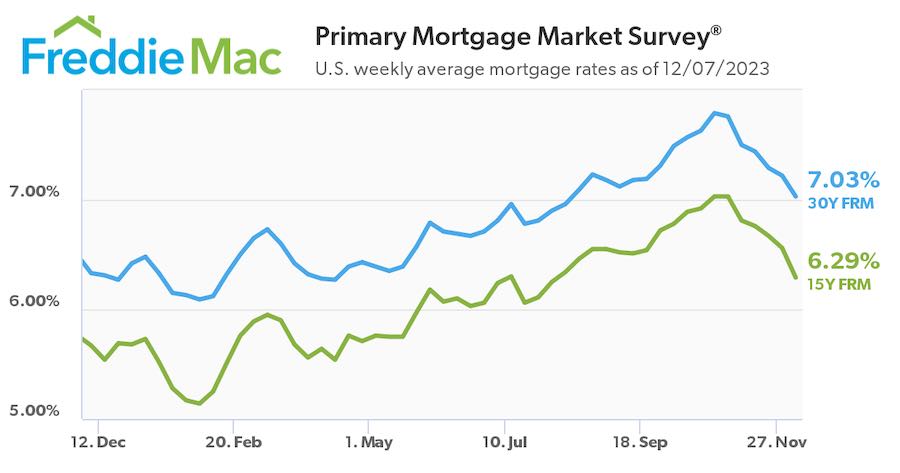

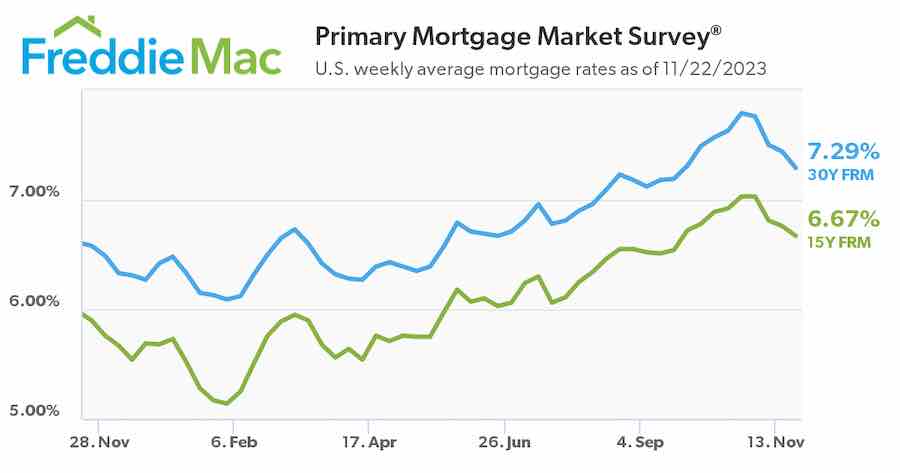

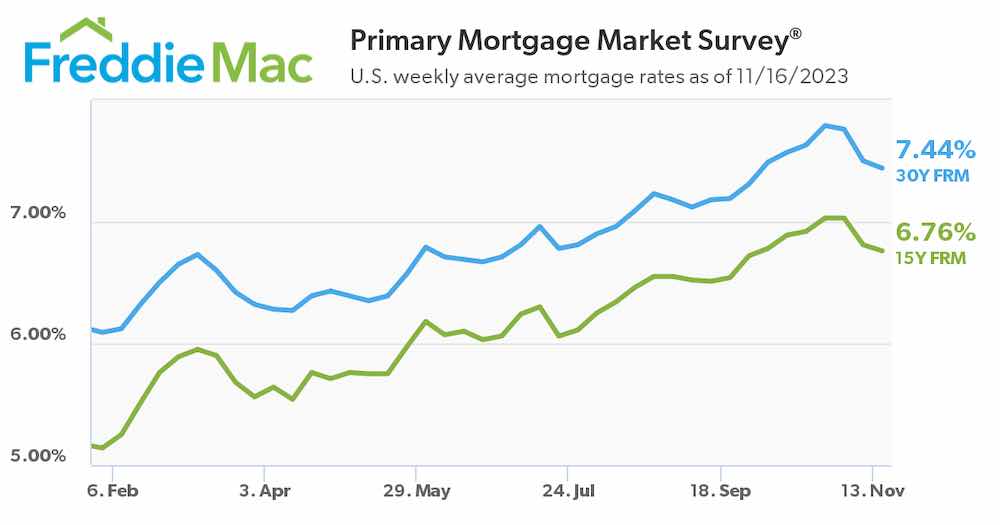

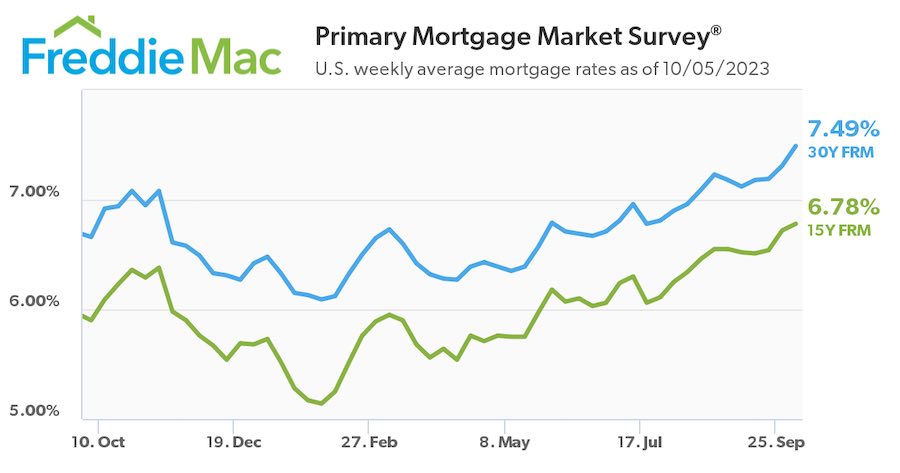

Mortgage interest rates are in the news again. They went up to 8% and are now down closer to 7%. They will likely go down more in 2024. There are all sorts of predictions about what a wonderful year 2024 will be.

Next year is almost always predicted to be better than this year. Home sales have been down this year. I’ll have some numbers in a few weeks. As interest rates go down moving will be more attractive to homeowners. Lower rates will also make housing more affordable. Some experts are predicting 6% interest rates by this time next year.

Is this a good time to buy a house? My answer is always the same. It depends upon your financial situation, where you want to move to, and if you plan on staying in the same area for at least five years. Timing is important.