The last time I wrote about vacant homes was in January of 2011. There were 1459 registered vacant buildings on the books in January this is way down from the all time record in the fall of 2008 which was 2031. There are vacant homes that are not on the list because the city does not require that all vacant homes be registered and there are a few cheaters out there too. . . you know who you are . .

two vacant houses in a row

Today we have 1421 registered vacant buildings. The list is on the city web site and I know they will move the page in a week or so and break my link so if you land on this article at some point in the future use Google and search on registered vacant buildings and city of St. Paul.*

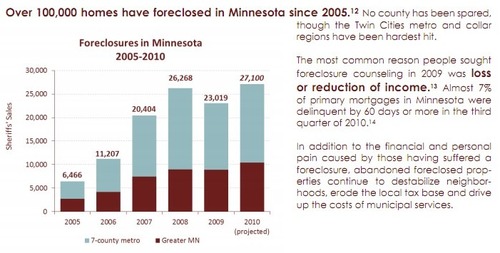

Nation wide there are a large number of vacant homes I have read estimates that there may be as many as 19 million of them. [Forbes]

Some of the homes that were vacant last year have been torn down, others have been rehabbed and some are still on the market. There isn’t any way to track the homes that are vacant but not registered. If you own an empty home it is important to let your insurance company know that it is vacant.

If you live next to a vacant home keep an eye on it and alert the police if there is suspicious activity.

*the city used to have one full time employee who did nothing but move pages on the city web site now they have two. If you are not a fan of broken links on your site do not link to an item on the city of St. Paul web site.