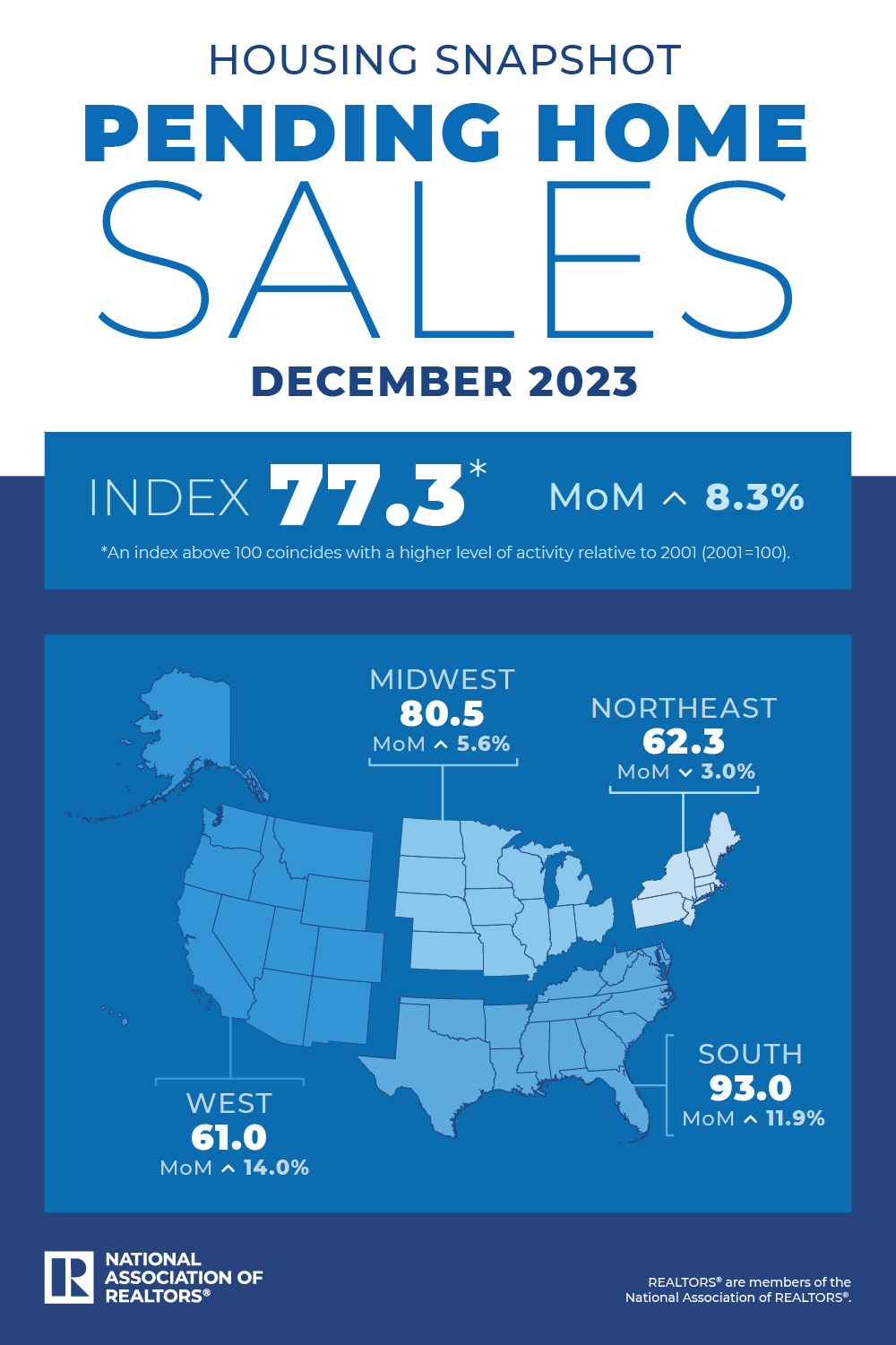

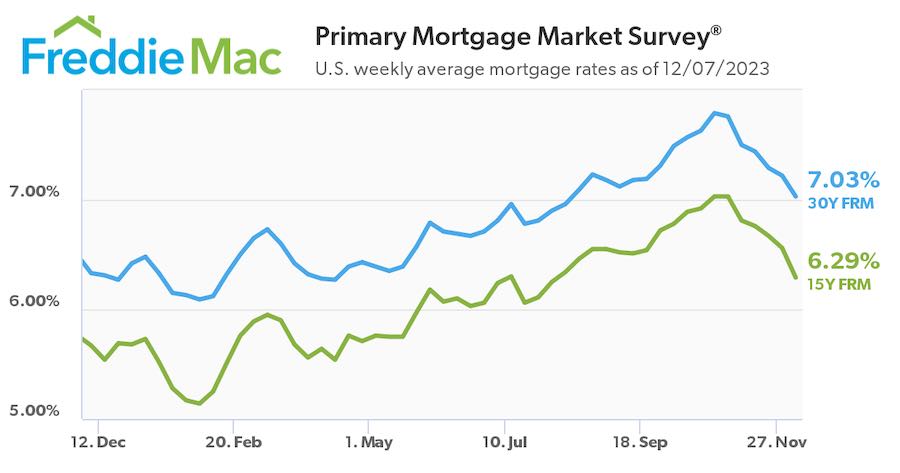

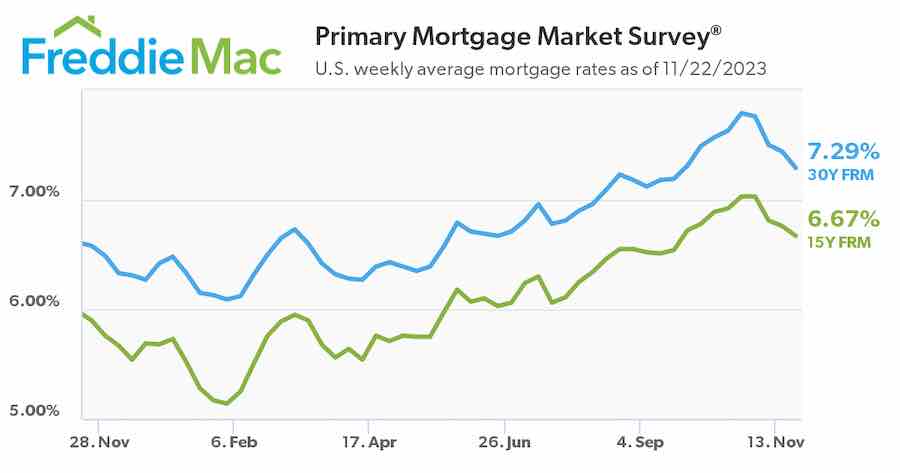

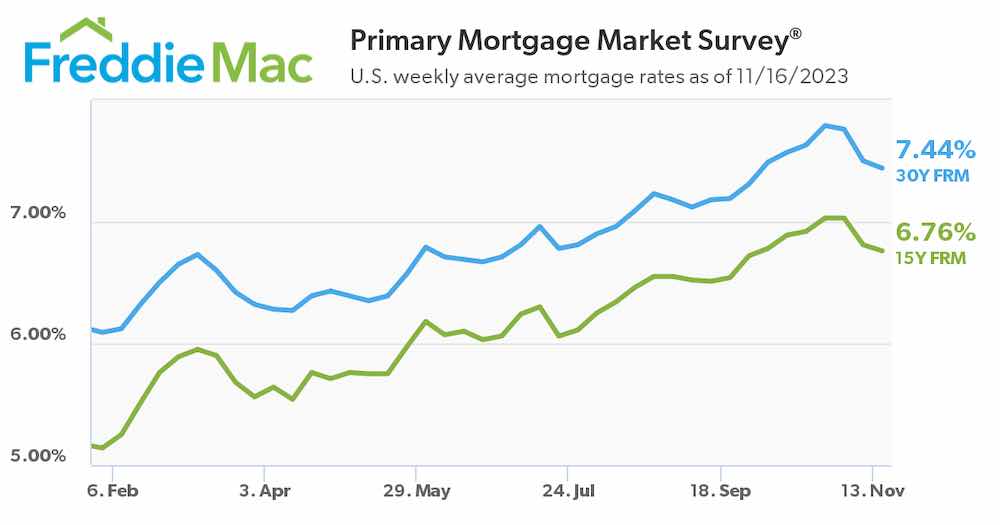

Apparently home sales were up in December from November. There is already talk about having hit some kind of a “bottom” when it comes to the number of home sales. I’ll go out on a limb and say that the sale of existing homes may be slightly higher in 2024 than in 2023 but I expect home sales to go up as interest rates go down. Keep your eye on those rates. According to Freddie Mac rates were on average above 6.5% last week on a thirty-year conventional mortgage. When they get to 5.5% and below we will start to see more activity in the housing market.

Here is the reason why: “The Mortgage Bankers Association reported the national median payment applied for by purchase applicants decreased last month to $2,055 from $2,137 in November.”

Mortgage interest rates matter.