According to the National Association of Realtors:

According to the National Association of Realtors:

“Single-family home sales declined to a seasonally adjusted annual rate of 3.8 million in March, down 4.3% from 3.97 million in February and 2.8% from the prior year. The median existing single-family home price was $397,200 in March, up 4.7% from March 2023.

At a seasonally adjusted annual rate of 390,000 units in March, existing condominium and co-op sales decreased 4.9% from last month and 11.4% from one year ago (440,000 units). The median existing condo price was $357,400 in March, up 5.8% from the previous year ($337,900).”

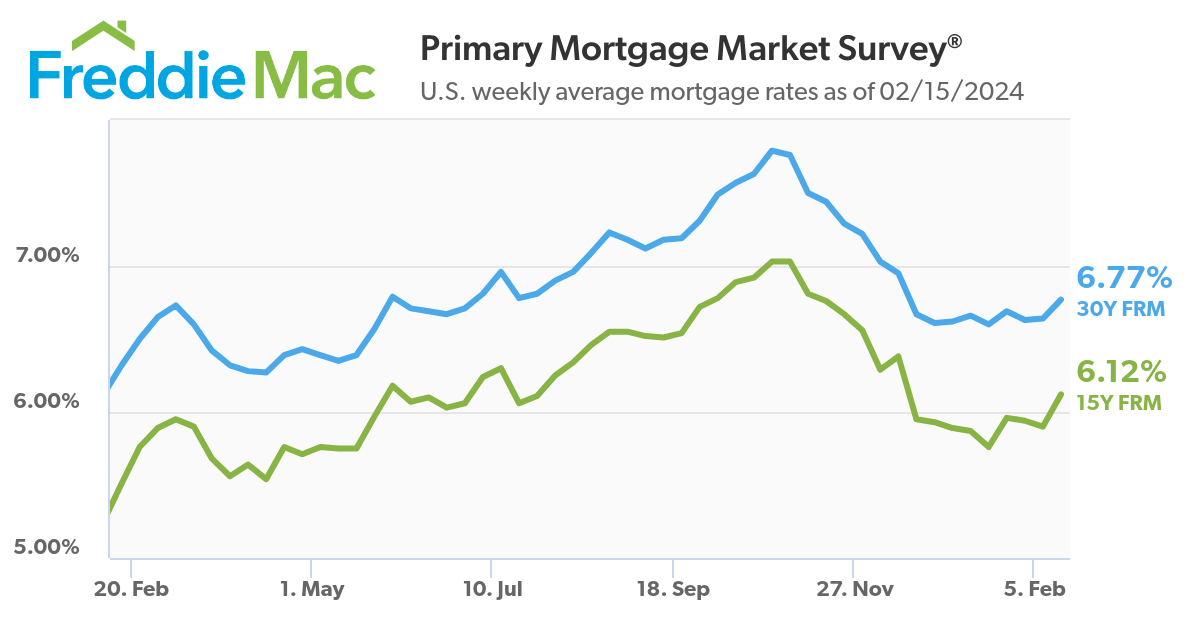

This year waiting until spring to sell a house may not have been the wisest choice. So much for hind site. When rates go down prices will go up due to the pent up demand from home buyers who did not want to pay the higher mortgage interest rates.

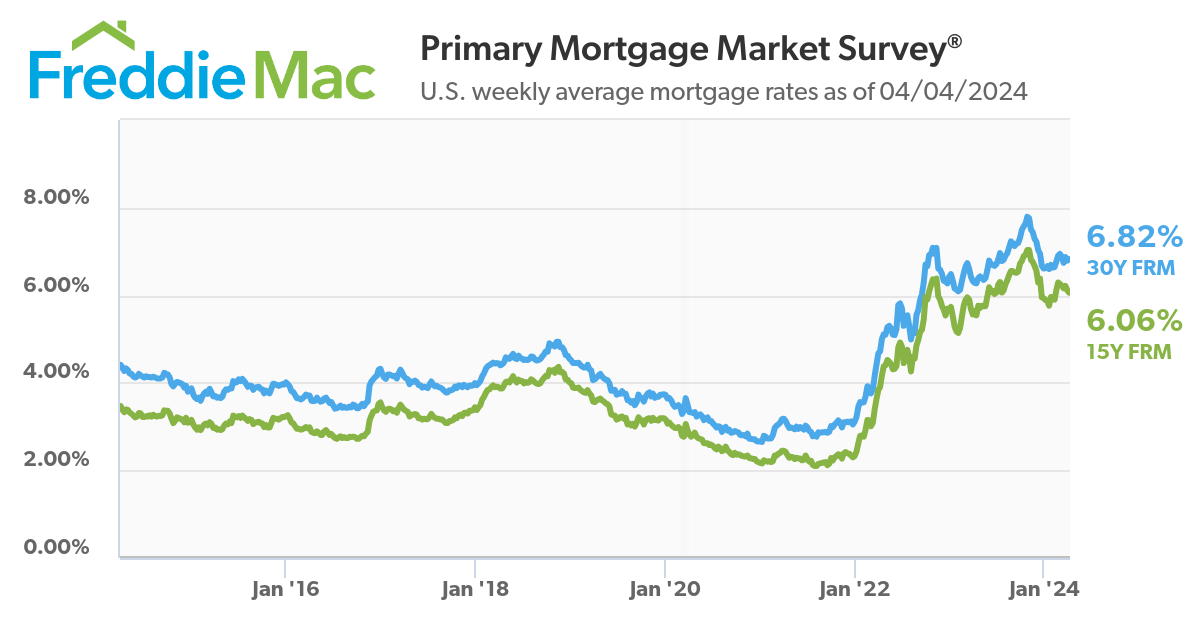

The best time to sell in 2024 may have already passed. Keep an eye on the interest rates.