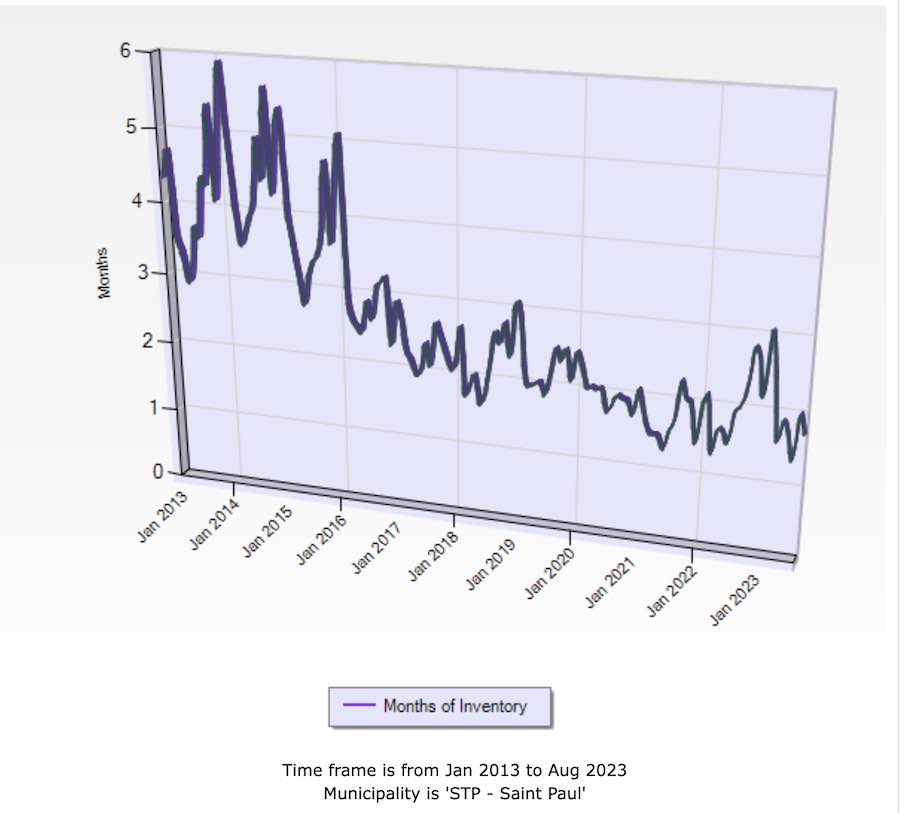

Sales continued to soften in August, but home prices showed their largest year-over-year gain in over 12 months. Many would-be sellers are choosing to stay put for now. Most sellers are also buyers, and higher mortgage rates combined with higher prices have truly harmed affordability.

MNR President Emily Green said, “We’re seeing people stay in their homes longer, particularly if they have an attractive mortgage rate. Some call this the ‘lock-in effect’ and it’s preventing needed inventory from hitting the market.”

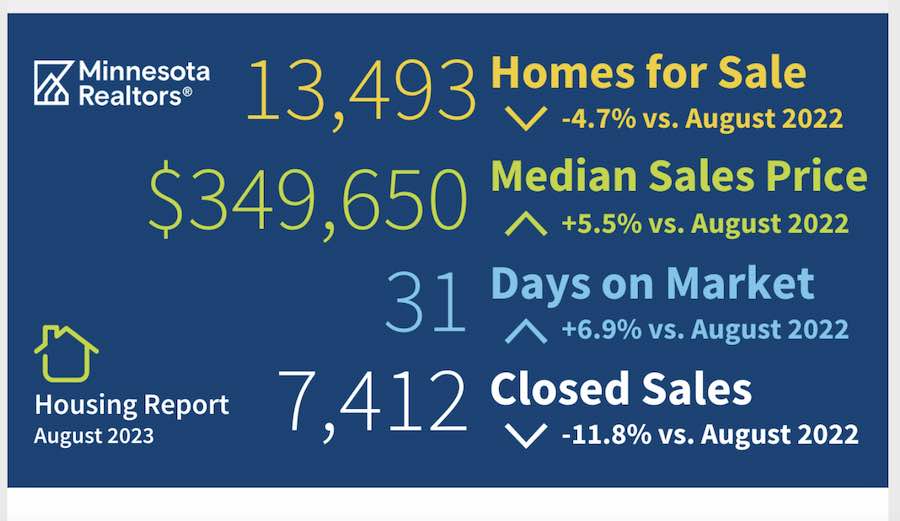

August Year-Over-Year Summary of Key Market Indicators:

- Closed sales: 7,412 (down 11.8%)

- Median sales price: $349,650 (up 5.5%)

- Average sales price: $408,107 (up 6.3%)

- New listings: 9,124 (down 0.4%)

- Pending sales: 6,806 (down 10.6%)

- Days on the market: 31 (up 6.9%)

- Homes for sale: 13,493 (down 4.7%)

In September the number of homes on the market is higher in the metro area than it was in August but still very low.